Introduction

The stock price of Alphabet Inc., the parent company of Google, plays a crucial role in the dynamics of the technology sector and the broader stock market. As investors closely watch the performance of major tech companies, understanding the movement of Alphabet’s stock price is vital for making informed investment decisions. With its sheer market influence and continuous innovation, Alphabet’s stock has significant implications for both the company and its investors.

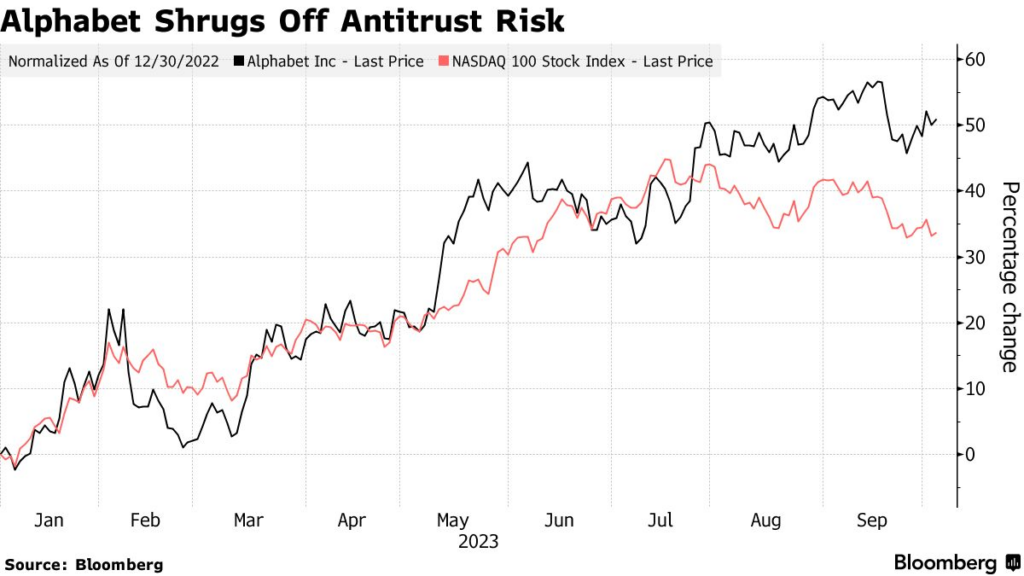

Current Stock Price and Historical Performance

As of October 2023, Alphabet’s stock price is hovering around $145 per share, reflecting a market capitalization of approximately $1.8 trillion. Throughout the past year, Alphabet has seen fluctuations between a high of $160 and a low of $120. This variability can be attributed to various factors, including shifts in advertising revenues, the company’s ventures into artificial intelligence, and competition within the digital market.

Recent Factors Influencing Stock Price

Several key events have influenced Alphabet’s stock price in recent months:

- Q3 Earnings Report: The recent earnings report revealed a 6% year-over-year growth in revenue, primarily driven by an increase in Google Cloud services, which has been a significant focus for the company.

- AI Innovations: Alphabet’s investments in artificial intelligence and machine learning technologies are showcasing strong potential, leading to investor confidence. The beta launch of its new AI-driven search capabilities has attracted positive market reactions.

- Regulatory Challenges: Ongoing investigations from regulatory bodies regarding antitrust concerns have put pressure on the stock price, as any unfavorable outcomes could affect its operational strategies.

Market Sentiment and Predictions

Analysts remain optimistic about Alphabet’s stock price in the long term, with projections estimating the price could rise to $180 by mid-2024, fueled by consistent revenue growth and expanding ventures into new technologies. However, short-term volatility is expected as the company navigates regulatory scrutiny and fluctuating market conditions.

Conclusion

The Alphabet stock price is a barometer for not only the company’s performance but also the overall health of the tech industry. With ongoing developments in digital advertising, cloud computing, and AI technologies, investors must remain vigilant and informed. Understanding the underlying factors that contribute to Alphabet’s stock price movements is crucial for making strategic investment choices in the ever-evolving market landscape.