Introduction

Trilogy Metals Inc. has been a notable player in the mining industry, particularly in the exploration and development of mineral resources, especially copper and zinc in North America. Understanding the stock’s performance offers valuable insights to investors, mining enthusiasts, and individuals interested in the overall health of the mining sector. With the increasing global demand for sustainable minerals, Trilogy Metals stock has garnered attention, making it essential to examine its recent trends and future outlook.

Recent Performance

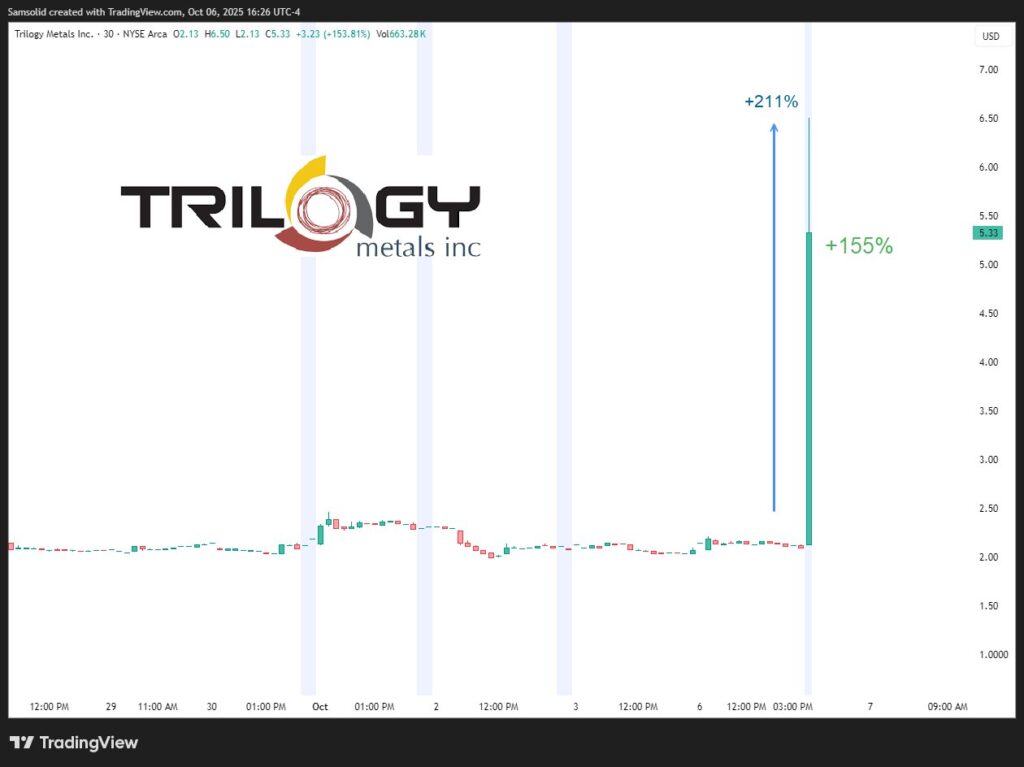

As of October 2023, Trilogy Metals stock has shown remarkable volatility, reflecting the broader fluctuations in both the commodity markets and investor sentiment. The company’s stock price, influenced by various factors including copper prices, geopolitical tensions, and company-specific developments, is currently trading at approximately $1.25 per share. This marks an increase from earlier in the year when the price was below $1.00, signaling a bullish trend as investors keep a close eye on the cumulative developments in the mining sector.

In August 2023, Trilogy reported significant drilling results from its Upper Aniak River area, which spiked investor interest and contributed to the stock price uptick. The positive results hint at the potential for increased reserves, directly enhancing the company’s valuation and performance.

Future Outlook

Looking ahead, analysts project continued growth for Trilogy Metals, particularly as global demand for copper, a key element in renewable energy systems, remains on the rise. The company’s focus on sustainable mining practices positions it well within the emerging green economy, potentially attracting socially responsible investments.

According to a report by Market Insights, the mining sector is anticipated to enjoy robust growth, driven by technological advancements and an uptick in electric vehicle production, both heavily reliant on copper and other key minerals. Analysts recommend investors to keep a close watch on Trilogy’s developments, particularly regarding its mining operations and exploration updates, which could significantly impact stock performance.

Conclusion

The stock performance of Trilogy Metals is emblematic of broader trends within the mining sector and illustrates the importance of mineral exploration in the context of a sustainable future. As the world moves towards greener energy solutions and more efficient technologies, Trilogy Metals may not only see increased stock value but also provide essential resources for a changing global economy. For investors, monitoring developments in Trilogy’s mining operations will be pivotal in gauging future stock performance and making informed investment decisions.