Introduction

The Dow Jones Industrial Average (DJIA), a key indicator of the U.S. economy, plays a crucial role in global financial markets. As one of the oldest and most recognized stock indices, it reflects the performance of 30 large, publicly-owned companies in the United States. Understanding the movements and trends of the Dow Jones today is essential for investors, analysts, and economic observers alike, as they navigate an environment marked by volatility and uncertainty.

Market Movements

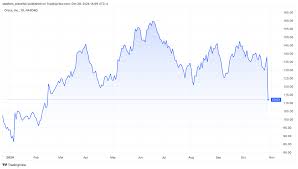

On October 24, 2023, the Dow Jones experienced notable fluctuations, opening at 33,542.54 points. Throughout the day, the index showed signs of resilience, influenced by positive earnings reports from major companies such as UnitedHealth Group and Microsoft. Analysts indicated that these results contributed to an overall optimistic outlook, despite ongoing concerns regarding inflation and interest rate hikes by the Federal Reserve. By midday, the DJIA rose approximately 1.2%, reflecting investor confidence after a challenging week.

Key Factors Influencing Today’s Performance

Several key factors are influencing the current state of the Dow Jones:

- Federal Reserve Policy: Market participants are closely monitoring the Federal Reserve’s stance on interest rates, as the expectation of another rate hike later this year has created an atmosphere of uncertainty.

- Corporate Earnings: Companies reporting strong quarterly earnings are buoying investor sentiment. Positive earnings from sectors such as technology and healthcare typically lead to boosts in stock prices.

- Economic Indicators: Recent economic data, including job growth and consumer spending, suggest a resilient economy that is recovering post-pandemic, although inflation remains a concern.

Market Forecasts

Looking ahead, analysts forecast mixed outcomes for the Dow Jones. Factors such as geopolitical tensions and domestic economic data will be crucial in determining the index’s trajectory. Some expect a potential dip if inflation persists or if the Federal Reserve adopts a more aggressive approach to combat it. Conversely, if major sectors, particularly technology and finance, continue to thrive, the DJIA could maintain its upward momentum.

Conclusion

Understanding the Dow Jones today is not just about tracking numbers; it embodies insights into the broader economic landscape. As investors and analysts keep a keen eye on ongoing trends, the interplay of multiple variables will continue to shape the performance of this key index. Amid complexities, it remains vital for stakeholders to stay informed and consider the potential impacts of macroeconomic developments.