Introduction

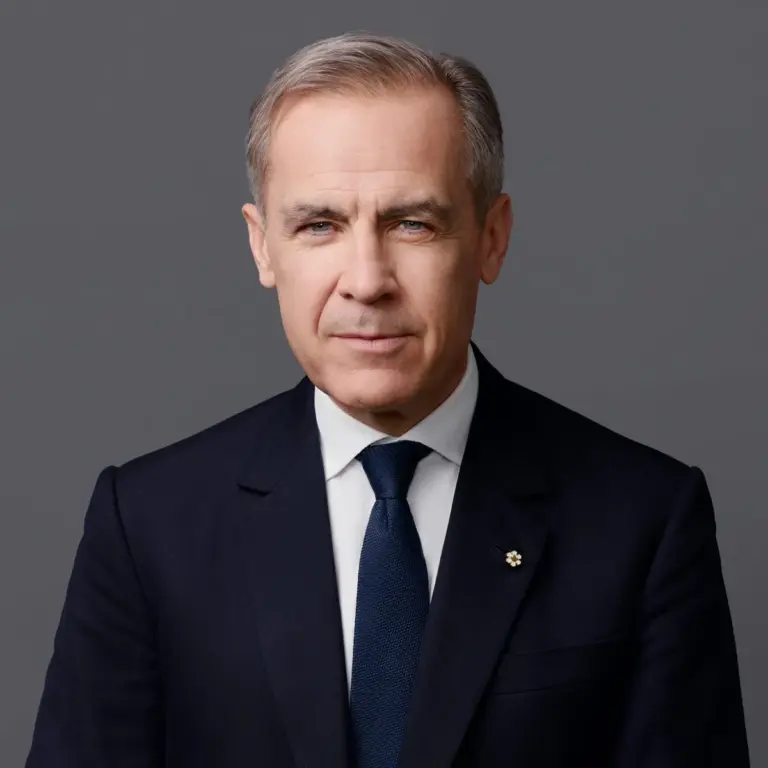

The intersection of finance and politics is often a complex and dynamic arena, particularly when it involves prominent figures such as Mark Carney and Donald Trump. Mark Carney, the former Governor of the Bank of Canada and the Bank of England, has been a pivotal player in global finance, while Donald Trump, the 45th President of the United States, has significantly impacted economic policy during his tenure. Understanding their relationship sheds light on broader economic implications.

Mark Carney’s Financial Policies

Carney’s leadership in the financial sector, particularly during the aftermath of the 2008 financial crisis, has garnered international recognition. His tenure as Governor of the Bank of England from 2013 to 2020 was marked by efforts to stabilize the UK economy through careful monetary policy and attempts to mitigate the risks associated with Brexit. Carney’s calls for sustainable finance and climate accountability have resonated globally, drawing attention to the necessary balance between economic growth and environmental responsibility.

Trump’s Economic Strategies

Trump’s economic policies, characterized by tax cuts, deregulation, and protectionist measures, have fundamentally reshaped the American economy. His administration’s approach to trade, particularly with key partners like China, contrasted sharply with the globalist stance that Carney often endorsed. Trump’s focus on America’s interests sometimes put policy experts at odds with central bankers like Carney, who advocate for a more interconnected global economy.

Conflicting Visions

The relationship between Carney and Trump has been marked by differing economic philosophies. For instance, during the G20 summit, Carney often championed initiatives focused on climate change and sustainable finance, while Trump’s administration prioritized immediate economic gains, sometimes dismissing long-term risks as bureaucratic overreach. This philosophical clash highlights the broader conversation about the future direction of economic policy and its implications for global markets.

Conclusion

The interactions between Mark Carney and Donald Trump reflect deeper ideological differences in economic governance. While Carney advocates for sustainability and long-term economic stability, Trump’s approach leans towards aggressive growth and nationalism. As global economies continue to face unprecedented challenges, such as climate change and geopolitical tensions, the outcomes of these differing philosophies will likely continue to shape the future of global finance. Observers of economic policy and international relations would benefit from paying close attention to how these influential figures influence ongoing discussions in an ever-evolving economic landscape.