Introduction

The TSX Index, or the S&P/TSX Composite Index, is a key benchmark for the performance of the Canadian equity market. It includes all companies listed on the Toronto Stock Exchange (TSX), representing a wide range of sectors. Understanding the TSX Index is crucial for investors, as it provides insights into the overall health of the Canadian economy, guides investment decisions, and reflects market sentiments.

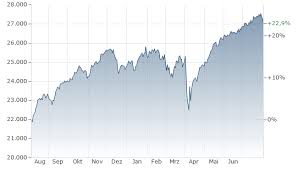

Current Trends and Performance

As of October 2023, the TSX Index has experienced significant fluctuations influenced by various global and domestic factors. After a volatile year in 2022, characterized by inflation uncertainties and shifting interest rates, the TSX was able to rebound in early 2023. Much of this recovery can be attributed to strong performances in sectors such as energy and materials, which are prominent within the index. In September 2023, the TSX Index reached a record high of approximately 22,000 points, reflecting a surge in commodity prices and investor confidence.

Sector Contributions

The TSX Index is heavily weighted towards specific sectors such as energy, financials, and materials. Energy stocks, particularly Canadian oil and gas producers, have seen substantial gains due to rising fuel prices. Additionally, the financial services sector, including major banks and insurance companies, continues to play a pivotal role, given their stability and significant contribution to Canada’s GDP. This sector has benefited from higher interest rates, which have widened margins for banks. Meanwhile, technology stocks, while more volatile, have begun to show promise, contributing to the index’s performance as digital transformation accelerates in various industries.

Conclusion and Forward Outlook

The TSX Index serves as an essential tool for investors looking to gauge the investment landscape in Canada. Given the current economic indicators, analysts forecast continued growth in 2024, especially within the energy and materials sectors. However, risks remain, including potential fluctuations in commodity prices and broader market volatility. For investors, watching the movements of the TSX Index will be crucial as it not only reflects market sentiments but also serves as a barometer for potential investment opportunities in the Canadian market.