Introduction

The cryptocurrency landscape is rapidly evolving, and Bitcoin remains at the forefront of this financial revolution. With its market dominance and increasing adoption, understanding the trajectory of Bitcoin as we approach 2025 is vital for investors, enthusiasts, and the general public. As experts predict various trends and changes within the cryptocurrency space, the relevance of Bitcoin in shaping financial systems worldwide cannot be understated.

Current State of Bitcoin

As of late 2023, Bitcoin has regained a significant position since its previous downturn, trading around CAD 70,000 and seeing a marked increase in institutional adoption. Noteworthy companies, such as Tesla and Square, have invested in Bitcoin, enhancing its credibility as a store of value similar to gold. Additionally, Bitcoin’s integration into payment systems is expanding, with numerous merchants accepting BTC for transactions, enhancing its utility.

Predictions for 2025

Experts in the cryptocurrency sector have made varying predictions about Bitcoin’s trajectory leading up to 2025:

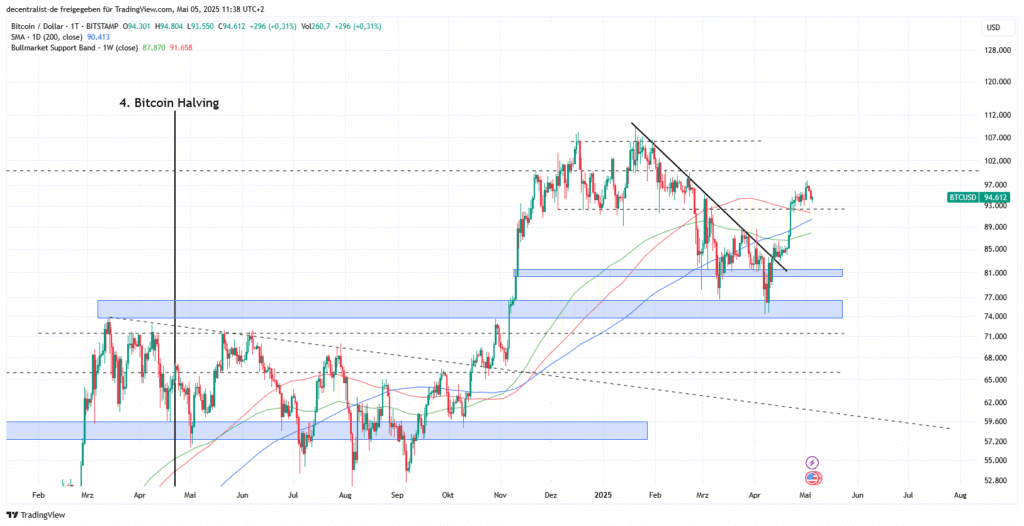

- Price Estimates: Analysts project varying Bitcoin prices ranging from CAD 100,000 to CAD 500,000 by 2025, driven by increased adoption and potential supply scarcity as block rewards decrease due to halving events.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies is expected to evolve significantly. In various jurisdictions, governments are proposing regulations to ensure consumer protection, tax compliance, and anti-money laundering measures, which could impact Bitcoin’s use and acceptance.

- Technological Advancements: Bitcoin’s underlying technology, the blockchain, is anticipated to evolve with Layer 2 solutions like the Lightning Network, enabling faster and cheaper transactions while enhancing scalability.

Challenges Ahead

While the future for Bitcoin appears promising, several challenges could impede its progress. Regulatory hurdles, environmental concerns surrounding mining, and market volatility remain key issues for investors and stakeholders. Moreover, emerging competition from other cryptocurrencies and central bank digital currencies (CBDCs) could pose threats to Bitcoin’s dominance.

Conclusion

As we look towards 2025, Bitcoin is poised to play a pivotal role in the global financial ecosystem. Its potential for significant price appreciation coupled with increased regulatory clarity may attract more mainstream users and institutions. However, challenges must be navigated carefully to ensure that Bitcoin can maintain its status as a leading cryptocurrency. For readers and investors, staying informed about developments within this space is essential for navigating the future of finance.