Introduction: The Importance of Investments

Investments play a crucial role in building wealth and securing financial futures for individuals and institutions alike. In 2023, the investment landscape is evolving rapidly due to various factors such as technological advancements, geopolitical tensions, and changing consumer behaviors. Understanding these trends is essential for making informed financial decisions that can influence both personal and corporate portfolios.

Key Current Trends in Investments

1. Rise of Sustainable Investing

In recent years, sustainable or ESG (Environmental, Social, and Governance) investing has gained considerable momentum. A recent report by Morningstar revealed that sustainable funds attracted more than $51 billion in net inflows in 2022 alone. Investors are increasingly looking for ways to align their financial goals with their values, driving demand for investments that prioritize ethical practices and social responsibility.

2. Technological Innovations and Digital Assets

Digital assets, including cryptocurrencies and NFTs (non-fungible tokens), continue to disrupt traditional investment avenues. Despite regulatory scrutiny, central banks are investigating digital currencies, suggesting a shift toward a more decentralized financial system. Additionally, fintech advancements have made investing more accessible, enabling a broader demographic to participate in stock markets through user-friendly trading apps.

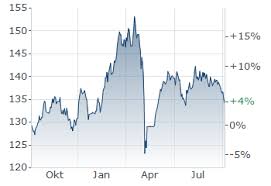

3. Increased Interest Rates and Inflation Concerns

The current economic environment is marked by rising interest rates and inflation concerns. As central banks, including the Bank of Canada, implement tighter monetary policies to combat inflation, investors are reassessing their strategies. Fixed income securities are seeing renewed interest as yields begin to rise, while equities face volatility as market participants weigh potential recession risks against earning growth.

4. Real Estate in Flux

The real estate market is also undergoing transformation as remote work influences housing demand. Urban areas are seeing slower growth, while suburban and rural properties gain appeal. With the ongoing shift in work dynamics, investors need to adapt by exploring different sectors, such as industrial real estate and logistics, which benefit from the e-commerce boom.

Conclusion: Looking Ahead

As we progress through 2023, the investment landscape will continue to change. Investors who stay informed and adapt to these trends will be better positioned to leverage opportunities and mitigate risks. With sustainability, technological innovations, economic shifts, and demographic changes shaping investment choices, it is crucial for both individual and institutional investors to adopt a forward-thinking approach in their financial strategies. The evolution of investments presents challenges, but it also offers unprecedented opportunities to grow wealth responsibly.