Introduction

As cryptocurrencies continue to gain traction among investors and mainstream audiences, Coinbase Stock (COIN) has emerged as a significant player in the financial markets. Coinbase Global Inc., a leading cryptocurrency exchange, went public in April 2021 and has since seen fluctuating valuations consistent with the volatile nature of digital currencies. Given the increasing interest in cryptocurrencies and the ongoing debates around regulation, the performance of Coinbase stock is more relevant than ever.

Recent Performance and Market Trends

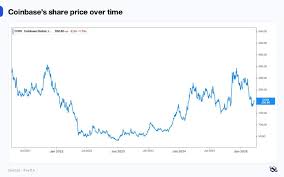

In recent months, Coinbase stock has experienced notable volatility. After reaching an all-time high of approximately $429 in April 2021, COIN’s value dropped significantly, closing around $60 in October 2023. The drop can be attributed to several factors, including the general downturn in the cryptocurrency market and broader economic issues such as inflation and interest rate hikes that affect high-growth tech stocks.

Investors have been closely monitoring Coinbase’s quarterly earnings reports. In its latest earnings call, the company reported a decline in trading volumes, which is critical as trading fees contribute significantly to its revenue. The firm generated $627 million in revenue for Q3 2023, a 38% decrease year-over-year. Nevertheless, the company has been diversifying its offerings, launching new features such as staking and introducing NFT marketplaces to boost user engagement and profitability.

Future Outlook

Looking ahead, analysts have mixed forecasts for Coinbase stock. Some analysts suggest that as regulatory clarity increases, Coinbase could stabilize and potentially grow its user base. Additionally, the ongoing development of cryptocurrency-related technologies may lead to new business opportunities for the exchange. However, it is essential to be aware of the inherent risks associated with cryptocurrency investments, including regulatory changes and market sentiment shifts.

Moreover, the overall economic context plays a pivotal role in Coinbase’s performance. If inflation rates stabilize and interest rates are not raised further, it may lead to increased investor confidence in the technology and cryptocurrency sector, positively impacting Coinbase stock.

Conclusion

The future of Coinbase stock remains uncertain and significantly influenced by the broader cryptocurrency market. Investors keen on Coinbase should closely follow ongoing market developments, regulatory changes, and company strategies to make informed decisions. While the risks are substantial, the potential for growth in the cryptocurrency sector continues to attract attention. As awareness and acceptance of digital assets grow, Coinbase could capitalize on its established market position to drive recovery and expansion in the upcoming quarters.