Introduction to IXHL Stock

IXHL stock, associated with the innovatively named IXHL Corporation, has recently gained attention in the investment community. As markets recover from the impacts of the pandemic, understanding the performance and fluctuations of IXHL stock becomes crucial for current and potential investors. This article delves into the current status and dynamics of IXHL stock, elucidating its relevance in today’s market.

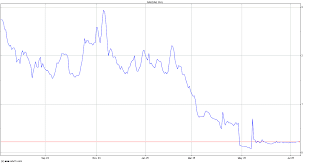

Recent Market Performance

As of October 2023, IXHL stock has shown significant movement. According to the latest data from market analysts, the stock has experienced a volatility index of 7.2 over the past month. This value indicates a moderate level of uncertainty among investors regarding the company’s future performance. On October 3rd, IXHL stock was trading at CAD 12.25, while it fluctuated throughout the month between CAD 11.50 and CAD 12.75 before stabilizing around CAD 12.00 by the end of the month.

Driving Factors Behind IXHL’s Trading Activity

The recent fluctuations can be attributed to several key factors. First, the company has been actively pursuing new market opportunities, including a potential expansion into North America’s renewable energy sector. This move aligns with broader market trends seeking sustainable solutions, garnering interest among eco-conscious investors. Additionally, quarterly earnings reports have indicated solid revenue growth of 15% year-over-year, buoying investor confidence.

Analyst Perspectives and Predictions

Analysts remain divided on the future trajectory of IXHL stock. Some experts project that if the company successfully navigates regulatory frameworks in the U.S., the stock may surge as high as CAD 15 within the next year. Meanwhile, other analysts express caution, citing potential market volatility and global economic conditions as significant risks. As a result, investors are advised to perform thorough due diligence before committing to IXHL stock.

Conclusion and Outlook

In conclusion, IXHL stock presents both opportunities and risks for investors in the current economic climate. Its recent performance highlights intrinsic stability amidst the volatile market landscape. With the company’s strategic initiatives and positive earnings trajectory, IXHL stock could offer considerable upside in the forthcoming months. However, the mixed sentiments from analysts suggest that investors should remain vigilant to any market changes. Overall, keeping a close eye on IXHL’s developments could prove beneficial for investment strategy and portfolio diversification.