Introduction

The earnings report of TD Bank for the third quarter of 2023 is an essential indicator of Canada’s financial health and the banking sector’s performance. Understanding the financial results can provide insights into the economic landscape, consumer behavior, and trends in the banking industry, especially as interest rates and inflationary pressures fluctuate.

Financial Performance Overview

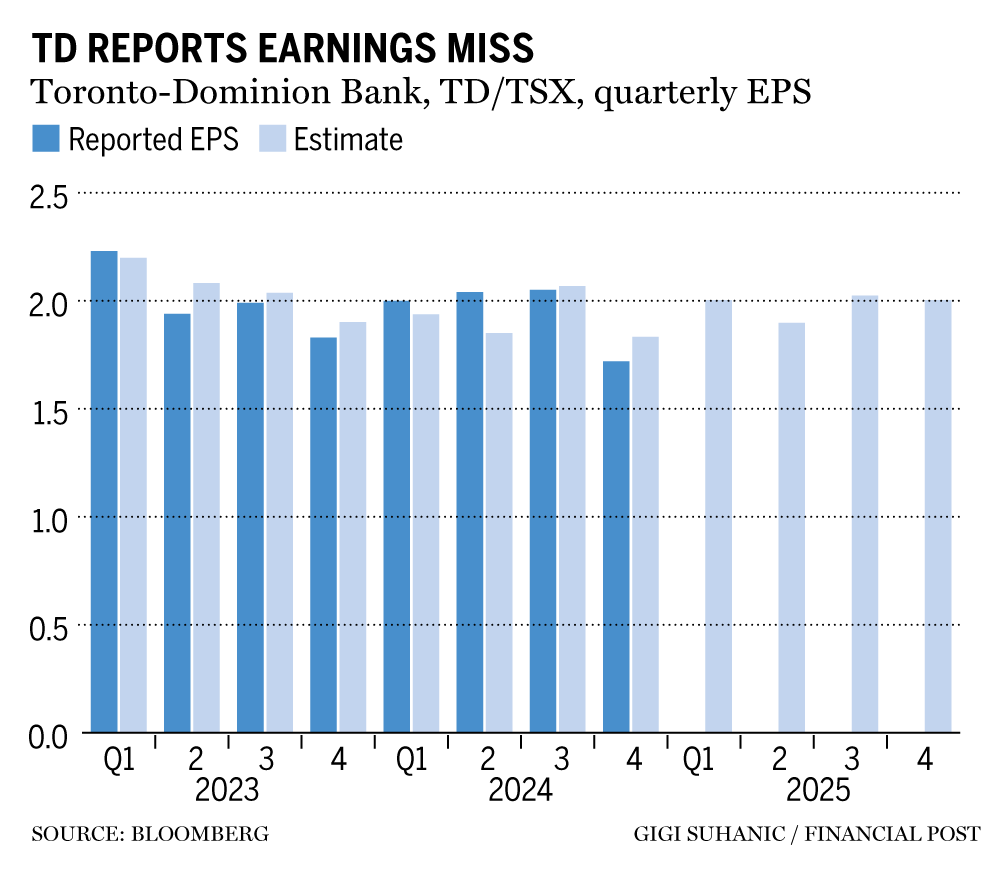

On November 29, 2023, TD Bank reported its earnings for Q3 2023, showcasing a robust performance driven by increased loan volumes and higher interest income. The bank posted a net income of CAD 3 billion, translating to a 15% increase from the previous year’s quarter. Earnings per share (EPS) also rose to CAD 2.25, exceeding analysts’ expectations, who had predicted an EPS of CAD 2.10.

The bank’s net interest income surged by 20% year-over-year, primarily attributed to the rising interest rates, which have bolstered the profitability of lending activities. Furthermore, the bank’s international division, including its operations in the United States, has contributed to this growth, highlighting its strategic positioning in both North American markets.

Key Contributors to Growth

Several factors have played a significant role in TD Bank’s impressive earnings. The escalating demand for personal loans and mortgages has been a significant contributor, as consumers continue to seek financial stability in a dynamic economic climate. Additionally, robust growth in the bank’s commercial lending sector reflects businesses’ confidence in investment opportunities.

Moreover, TD Bank’s cost-control measures and digital transformation initiatives have improved operational efficiency, enabling the company to maintain a strong return on equity (ROE), recorded at 17% this quarter.

Challenges and Market Outlook

Despite the positive results, TD Bank faces challenges, including the potential impacts of a slowing economy and rising delinquency rates. Analysts have cautioned that while the bank’s current performance is strong, external factors such as inflation and potential shifts in the housing market could pose risks to future earnings.

Looking ahead, TD Bank plans to further enhance its digital banking services and expand its customer base, particularly in underserved sectors. The bank is also closely monitoring the regulatory environment in both Canada and the U.S. to ensure compliance and adaptability.

Conclusion

In summary, TD Bank’s Q3 2023 earnings report highlights significant growth in profitability driven by increased lending and strategic initiatives. While the bank enjoys a strong market position, careful attention to emerging risks and continued focus on innovation will be essential for sustaining its success. Investors and stakeholders should remain vigilant as the bank navigates the complexities of the current economic landscape.