Introduction

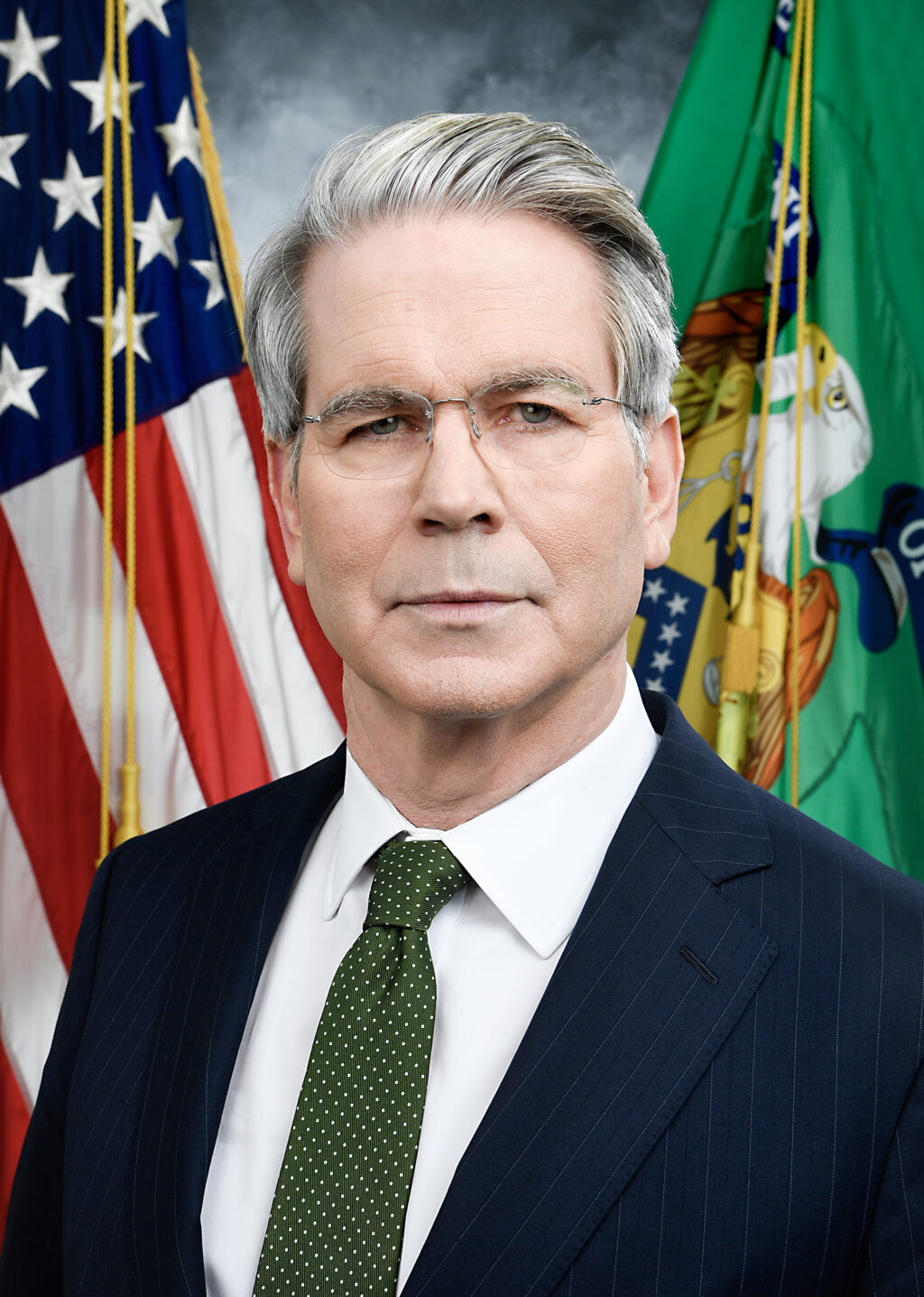

In the ever-evolving world of finance, well-respected figures like Scott Bessent have made significant marks, influencing investment strategies and management techniques. Bessent, known for his strategic insight and leadership within the financial sector, is especially relevant today as the global economy confronts uncertainty and fluctuating markets. His perspectives on macroeconomic trends, risk management, and investment opportunities provide invaluable guidance to investors and stakeholders alike.

Career Overview

Scott Bessent has carved a niche for himself in the landscape of investment management. After earning his MBA from the University of Chicago, he began his career at the prestigious investment firm, Soros Fund Management. There, he served as Chief Investment Officer, gaining recognition for his tactical allocation strategies and for successfully navigating financial volatility.

In 2014, Bessent launched his own investment management firm, Key Square Group, where he focuses on global macro strategies. Under his direction, Key Square has attracted a diverse portfolio, demonstrating the firm’s prowess in capitalizing on trends across various markets. Bessent’s ability to analyze complex economic indicators is also exemplified through his notable contributions to investment circles, where he frequently shares his forecasts and market insights.

Recent Developments

Recently, as the global economy faces challenges such as inflationary pressures and geopolitical tensions, Bessent remains a critical voice in investment discussions. In recent interviews, he emphasized the importance of adaptive strategies and caution against overly aggressive risk-taking. His analyses suggest that while potential opportunities exist, especially in emerging markets, investors should remain vigilant and well-informed.

Furthermore, Bessent has highlighted the growing relevance of environmental, social, and governance (ESG) criteria in investment decisions. He believes that sustainability will play a crucial role in determining long-term investment viability, an assertion that resonates in today’s socially conscious market.

Conclusion

Scott Bessent’s influence in investment management is poised to grow as the financial landscape evolves. His ability to adapt to new information and shifting conditions allows him to stay ahead of the curve, and his insights are invaluable for both institutional and individual investors. As we move into a period characterized by uncertainty, Bessent’s perspectives will likely provide clearer pathways for navigating complex investment decisions. Keeping an eye on his future analyses and strategies could be crucial for anyone looking to understand the dynamics of global markets in a post-pandemic era.