Introduction

RKLb stock has become a focal point for investors interested in the burgeoning field of biotechnology. As the global market for innovative therapeutics continues to expand, understanding the factors influencing RKLb stock’s performance is essential for potential investors and stakeholders. The relevance of this stock is underscored by its recent fluctuations, making it a topic of keen interest in finance and investment circles.

Current Market Performance

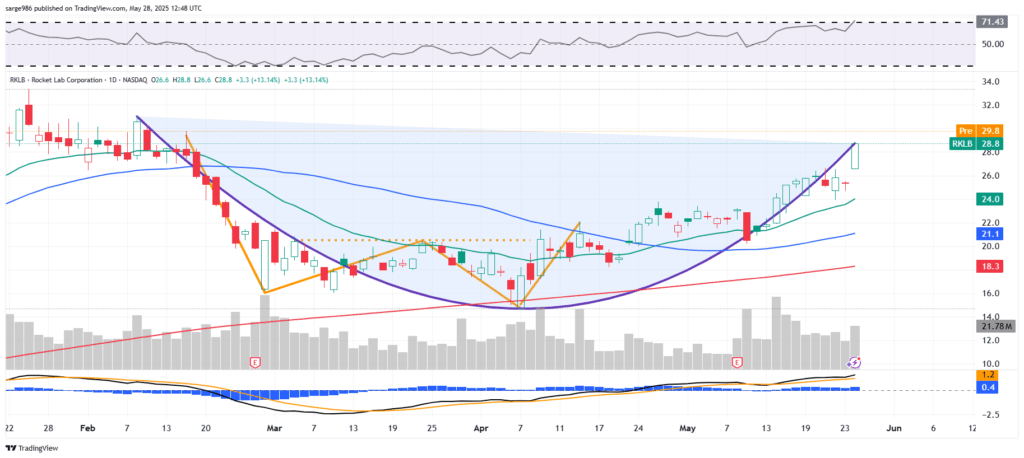

As of October 2023, RKLb stock has shown significant volatility. Starting the month with a market price of $15.00 per share, it experienced a peak at $17.50 before stabilizing around $16.20. This fluctuation reflects wider market trends in the biotech sector driven by various economic indicators, investor sentiments, and company-specific news. Analysts attribute part of this volatility to ongoing developments in the company’s pipeline, including promising clinical trial results that were recently announced.

Contributing Factors to RKLb’s Price Movement

Several critical factors have influenced the trajectory of RKLb stock. Firstly, the recent announcement of successful Phase II clinical trials for their flagship drug has triggered a positive response from the market. Additionally, the company’s strategic partnerships with major pharmaceutical firms have bolstered investor confidence, paving the way for potential revenue increases. On the flip side, concerns regarding regulatory approvals and competition from emerging biotechnologies remain a worry, contributing to the stock’s instability.

Future Outlook

Looking ahead, market experts emphasize that while RKLb stock appears promising, investors should remain cautious. Continued progress in clinical development and successful partnerships could push the stock higher. However, potential setbacks in clinical trials or unfavorable regulatory outcomes could lead to increased volatility. Therefore, prospective investors are advised to watch upcoming quarterly earnings reports and any news regarding product approvals closely, as these could significantly impact RKLb’s market performance.

Conclusion

In summary, RKLb stock presents both opportunities and challenges for investors navigating the dynamic biotechnology landscape. While its recent upward trends are encouraging, market participants must remain vigilant regarding potential risks. Staying informed about company developments and broader market conditions will be critical for those looking to engage with RKLb stock as we move deeper into 2023.