Introduction

Microsoft Corporation, a cornerstone of the technology sector, has been a focal point for investors in 2023 due to its significant advancements in AI, cloud computing, and other emerging technologies. As the company continues to expand its offerings and maintain robust financial health, it’s essential for both seasoned and new investors to stay updated on its stock performance. Understanding the dynamics of Microsoft stock can indicate broader market trends and the tech sector’s resilience.

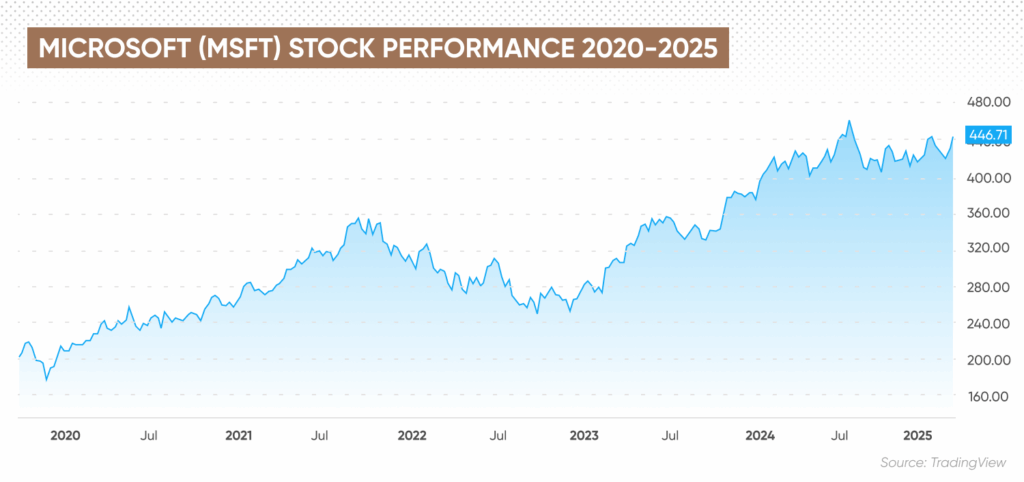

Current Stock Performance

As of October 2023, Microsoft shares have shown a steady upward trend, primarily due to impressive quarterly earnings reports. The company reported a revenue increase of 15% year-over-year, largely attributed to its Azure cloud services and Office 365 growth. With a current stock price hovering around USD 350 per share, investors are optimistic. Analysts project the stock will hit new highs by the end of the fiscal year, driven by ongoing demand for digital transformation among businesses.

Market Drivers

Several factors are influencing the performance of Microsoft stock:

- Artificial Intelligence: Microsoft’s investment in AI technology, particularly with the integration of ChatGPT-like functionalities into their products, has excited the market. This innovative focus could potentially yield substantial long-term growth.

- Cloud Computing: The demand for Microsoft Azure has skyrocketed, as organizations increasingly migrate to cloud services. This trend not only boosts revenue but also strengthens Microsoft’s position against competitors like Amazon and Google.

- Acquisitions: Strategic acquisitions, including gaming and tech startups, are enhancing Microsoft’s portfolio and market reach, further reinforcing investor confidence.

Recent Challenges

Despite its successes, Microsoft faces challenges that could impact its stock price. Regulatory scrutiny of big tech companies is increasing, with potential antitrust actions looming. Additionally, the overall economic climate, including inflation and interest rate fluctuations, can potentially influence investor behavior and stock volatility.

Conclusion

In summary, Microsoft stock remains a key player in the tech investment landscape of 2023, buoyed by strong financial performance, innovative technological advancements, and strategic growth initiatives. For investors, keeping an eye on Microsoft will be crucial, as it not only reflects the company’s health but also serves as a barometer for the tech industry’s viability in the current economic environment. Looking toward the future, many analysts forecast continued growth for Microsoft stock, making it a significant consideration for both new and seasoned investors.