Introduction

The stock of Klarna, a prominent player in the buy now, pay later (BNPL) market, has become a key focus for investors and analysts alike. Understanding the fluctuations in Klarna stock is vital for those interested in the fintech sector, especially as consumer behavior shifts and economic conditions evolve. Klarna’s recent performance reflects broader trends in technology-driven financial services.

Klarna’s Market Position

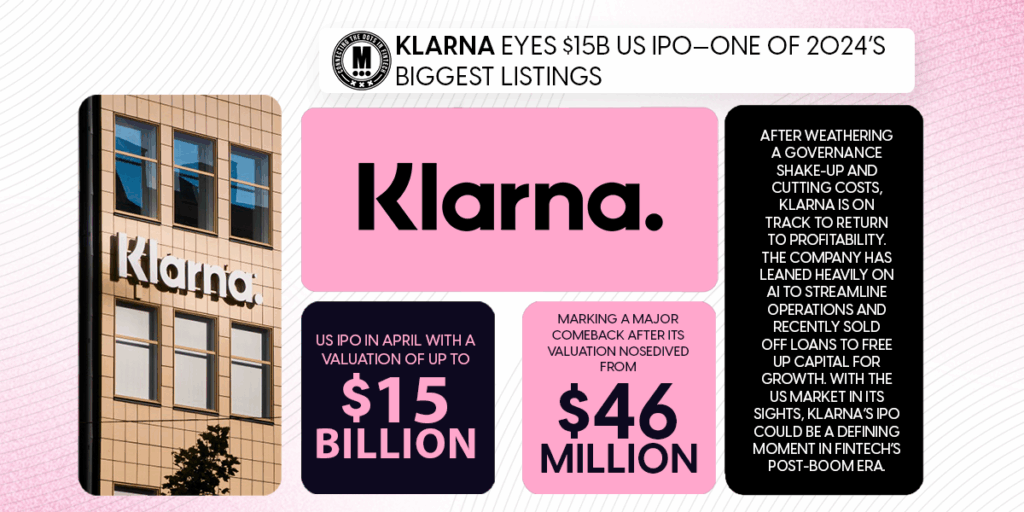

As of October 2023, Klarna, founded in 2005 in Sweden, has established itself as one of the leading BNPL service providers globally. The company, once celebrated for its massive valuation, is currently facing challenges as interest rates rise and consumer spending patterns shift. In early October, Klarna’s stock traded at approximately $7.30, showcasing a significant decrease from its peak valuation of $46 billion in 2021.

Recent Performance and Factors Influencing the Stock

Recent reports show that Klarna has been implementing strategic measures to stabilize its operation and improve profitability, including cost-cutting initiatives and a focus on expanding its merchant partnerships. Furthermore, Klarna’s user base and transaction volumes have continued to grow, which is a positive indicator for its long-term trajectory. However, rising inflation and economic uncertainty have raised concerns about the sustainability of consumer debt levels, directly impacting Klarna’s stock value.

This volatility is mirrored in the broader stock market, where fintech stocks have struggled to maintain their pandemic-era highs. Analysts also note that investor sentiment has shifted towards profitability over growth potential, which puts even more pressure on Klarna to demonstrate its financial health in future earnings reports.

Future Outlook

Going forward, analysts suggest that Klarna’s stock will largely depend on its ability to navigate the current financial landscape. With many competitors also vying for market share in the BNPL space, Klarna must leverage its technology to enhance user experience while adapting its business model to changing economic realities.

The potential for future growth remains high if Klarna can mitigate risks and maintain a strong customer base. Furthermore, as fintech innovation continues to demand attention, Klarna’s adaptability may well determine its success on the market moving into 2024 and beyond.

Conclusion

The performance of Klarna stock is a microcosm of the broader challenges facing the financial technology sector. Investors are advised to keep a close eye on developments within the company, including quarterly earnings and emerging business strategies, to better assess their investment risk. The ongoing evolution of consumer finance solutions will undoubtedly shape Klarna’s future, making it an important company to watch in the coming years.