Introduction

Nvidia Corporation has been a crucial player in the technology sector, particularly in the fields of graphics processing units (GPUs) and artificial intelligence (AI). As a result, its stock performance has garnered significant attention from investors and analysts alike. Understanding the trends and potential projections for Nvidia stock is essential for anyone interested in the tech market, especially as it plays a pivotal role in the development of AI technologies, gaming, and data centers.

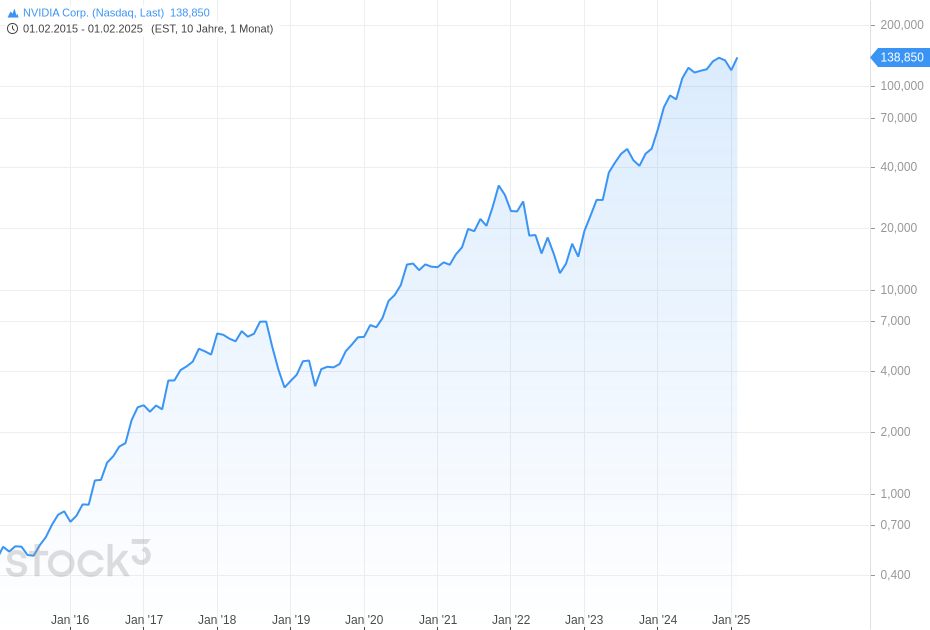

Stock Performance Overview

As of late 2023, Nvidia’s stock has seen volatile trading patterns, largely driven by the release of its financial results and developments in the AI sector. In August 2023, Nvidia reported earnings that surpassed expectations, with revenue reaching $13.5 billion, a remarkable increase compared to the previous year. This impressive growth was fueled by the rising demand for AI and cloud computing solutions. Following the earnings release, Nvidia’s share price surged by as much as 30% over a few trading days, reaching an all-time high.

Factors Influencing Nvidia Stock

Several factors are contributing to Nvidia’s stock trajectory. The surge in AI applications and increasing adoption of GPU technology in data centers have positioned Nvidia as a frontrunner in the industry. Recent partnerships with major tech firms like Microsoft and Google have further solidified Nvidia’s market position. However, external factors, such as geopolitical tensions affecting semiconductor supply chains and regulations surrounding AI technology, could impact future performance.

Market Analysts’ Predictions

Analysts have been optimistic about Nvidia’s performance in the coming quarters, often revising their target prices upward. Most analysts believe that the demand for AI-related hardware and software will continue to rise, promising stability and growth for Nvidia. The consensus price target among analysts in late 2023 is estimated at around $600 per share, reflecting a bullish outlook on Nvidia’s capabilities and market influence.

Conclusion

Nvidia stock appears to be on a path of considerable opportunity, driven by advancements in AI and the growing demand for high-performance computing. As companies continue to integrate AI into their core operations, Nvidia’s strategic position is likely to enhance its growth potential, making it a stock worth monitoring for future investment decisions. Investors should stay informed on both market trends and technological developments to understand how these factors may influence Nvidia’s stock performance moving forward.