Introduction

MSTR stock, representing MicroStrategy Incorporated, has garnered significant attention in financial markets, particularly due to its unique investment strategy focused on Bitcoin acquisition. As institutions increasingly embrace cryptocurrencies, understanding MSTR’s fluctuations becomes vital for investors and market analysts.

Recent Developments

As of late October 2023, MSTR stock has experienced notable volatility, attributed largely to MicroStrategy’s continuing commitment to Bitcoin investment. The company recently confirmed that it had increased its Bitcoin holdings to over 152,000 BTC, worth approximately $4.5 billion at current market prices. This strategic move aims to bolster its balance sheet and position MicroStrategy as a leading player in the Bitcoin investment landscape.

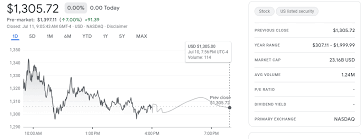

In addition, MSTR’s stock price has seen a resurgence, recovering from lows earlier in the year. By the end of October 2023, the stock was trading around $350—an increase of nearly 60% since the start of Q3. Analysts attribute this uptick to a combination of favorable market conditions for Bitcoin and heightened interest from institutional investors seeking exposure through MicroStrategy’s unique business model.

Market Analysis

The broader implications of MSTR’s investment strategy have attracted mixed opinions among market analysts. Proponents argue that MicroStrategy’s aggressive Bitcoin acquisition strategy positions it favorably among tech firms, providing investors with a liquid asset while leveraging the potential upside of cryptocurrency. Critics, however, caution against the inherent volatility of Bitcoin, highlighting risks associated with holding large quantities of a speculative asset.

Moreover, David Koci, a senior market analyst at XYZ Investments, noted, “MicroStrategy has effectively positioned itself as a Bitcoin proxy, allowing traditional investors to gain exposure to cryptocurrency without direct investment. However, it remains crucial to monitor Bitcoin’s price movements, as they will significantly influence MSTR’s stock performance moving forward.”

Conclusion

In conclusion, MSTR stock remains a pivotal indicator for both cryptocurrency enthusiasts and traditional investors. With MicroStrategy’s significant investments in Bitcoin, the stock’s trajectory will likely continue to reflect broader trends in the cryptocurrency market. As the landscape evolves, keeping an eye on legislative developments, macroeconomic factors, and Bitcoin’s performance will be essential for stakeholders looking to make informed investment decisions surrounding MSTR stock.