Introduction

The stock price of Google, officially known as Alphabet Inc. (GOOGL), has become a significant topic for investors and analysts alike. As one of the largest technology companies in the world, Google’s performance on the stock market can have widespread implications, affecting everything from market trends to individual investment strategies. With the ongoing developments in the tech industry and global economy, understanding Google’s stock price dynamics is more crucial than ever.

Current Stock Price Performance

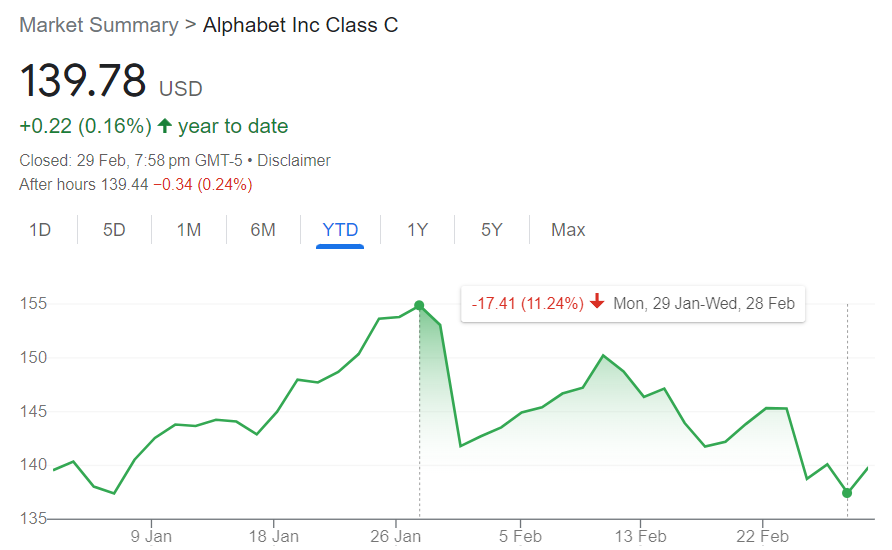

As of the latest trading session, Alphabet Inc. stock is valued at approximately $2,900. The tech giant has seen fluctuations in its stock price over the past few weeks, attributed to various factors, including earnings reports, market sentiment, and global economic conditions. Comparable to other tech stocks, Google’s prices have experienced volatility, influenced significantly by recent economic data and inflation concerns. Analyst forecasts indicate that the company’s strong fundamentals, such as robust revenue from advertising and innovative ventures in artificial intelligence, position it well for long-term growth, despite short-term market corrections.

Key Drivers Influencing Google’s Stock Price

Several key factors are influencing Google’s stock price movements. Most notably:

- Earnings Reports: Recent quarterly earnings highlighted a substantial year-over-year revenue growth driven primarily by digital advertising and a surge in Google Cloud services.

- Market Sentiment: Investor sentiment remains cautious amid fluctuating interest rates and concerns over inflation, impacting tech stocks disproportionately.

- Regulatory Scrutiny: Ongoing investigations regarding antitrust practices and privacy regulations may create uncertainty affecting investor confidence.

Conclusion and Future Outlook

The outlook for Google’s stock price remains bullish in the long run, as the company continues to innovate and expand its market share. While short-term fluctuations are to be expected, the fundamentals of Alphabet Inc., including diverse revenue streams and strong demand for technology, suggest that it may weather current economic storms effectively.

For investors, staying informed about Google’s market performance and the broader economic landscape is essential for making educated decisions. Watching for their upcoming earnings report and strategic moves in the tech space will provide further insights into the stock’s potential trajectory.