Introduction

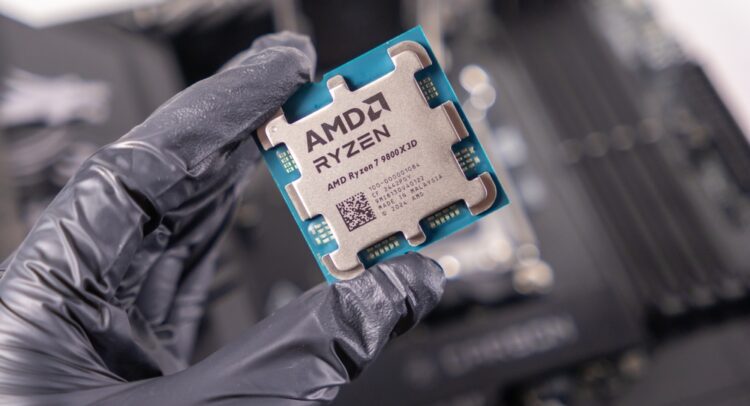

As one of the leading semiconductor companies, AMD (Advanced Micro Devices) plays a crucial role in shaping the technology industry’s landscape. Recent fluctuations in AMD stock reflect broader trends within the sector, driven by factors such as the growing demand for computing power, market competition, and advancements in artificial intelligence. Understanding these dynamics is essential for investors and tech enthusiasts alike, particularly as we navigate the complexities of the current market environment.

Current Market Performance

As of late October 2023, AMD stock has shown notable volatility, reflecting investor sentiment and external market pressures. After experiencing a significant rally earlier in the year, driven by strong sales in GPUs and CPUs, the stock has faced challenges due to inflation concerns and potential interest rate hikes. As of the latest trading session, AMD shares were priced at approximately CAD 120, marking a 15% decrease from its year-to-date high.

Factors influencing this decline include a competitive landscape in the semiconductor space, where AMD faces intense pressure from rivals like NVIDIA and Intel. Recent earnings reports indicated that while AMD continues to gain market share in data centers and gaming, the slow recovery in consumer spending is exerting downward pressure on growth forecasts.

Technological Advancements and Future Outlook

A key aspect contributing to AMD’s resilience is its commitment to innovation. The company announced the forthcoming release of its new Zen 5 architecture, which is expected to enhance processing capabilities significantly, particularly for artificial intelligence applications. Analysts predict that the successful launch of this technology could bolster AMD’s market position and improve stock performance by the end of Q4 2023 and into 2024.

Furthermore, AMD’s strategic partnerships with major cloud providers and expanding data center operations are likely to drive revenue growth. The high demand for chips used in AI and machine learning is expected to offer AMD further opportunities for expansion and profitability.

Conclusion

The future of AMD stock remains closely tied to technological innovations and market forces. Investors should remain vigilant to trends in consumer demand and macroeconomic factors influencing the tech sector. While volatility may persist in the short term, the potential for recovery in AMD’s stock price, driven by solid fundamentals and growth strategies, presents an attractive opportunity for those willing to navigate the ups and downs of the stock market. Analyzing the upcoming release of new products and quarterly earnings reports will be crucial for making informed decisions regarding AMD stock in the upcoming months.