Introduction

The TSX (Toronto Stock Exchange) Index is a crucial indicator of the economic health of Canada, reflecting the performance of the top companies listed on the exchange. For investors and analysts alike, keeping track of the TSX Index today is vital as it directly influences investment strategies and market forecasts amidst fluctuating economic conditions.

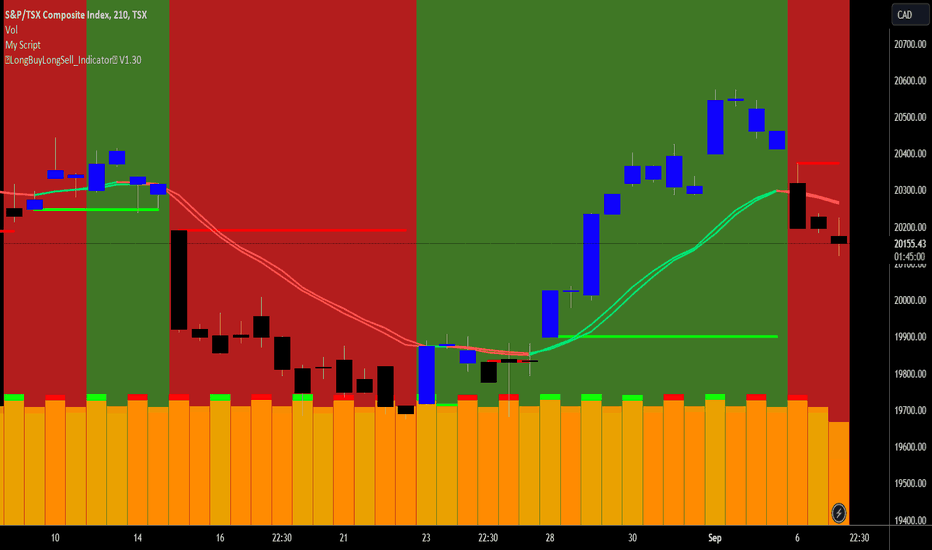

Current Performance of TSX Index

As of today, the TSX Index has displayed a mixed performance with sectoral rotations leading to a 0.5% fluctuation throughout the trading day. Key contributors to this performance include energy and materials sectors, which are experiencing price adjustments due to global commodity fluctuations. Notably, companies such as Suncor Energy and Barrick Gold have seen shifts in their stock values, reflecting broader trends in resource prices.

Market Influencers

Several external factors have influenced today’s TSX Index movements. The Bank of Canada has recently signaled a stable interest rate environment, which generally supports equity markets. Additionally, geopolitical tensions and inflationary pressures have caused cautious investor sentiments, resulting in a cautious approach towards trading. Economic data released today, showing a rise in retail sales, has provided some support to the index, suggesting consumer confidence is slowly recovering.

Conclusion

In sum, the TSX Index today illustrates the intricate balance of sector performance, economic indicators, and external market influences. Investors are advised to remain vigilant as market conditions can change swiftly. Given the current economic landscape, the forecast for the TSX Index remains cautiously optimistic, bolstered by potential recovery signals, especially in consumer spending. Monitoring the TSX is essential for those looking to navigate their investment in Canada’s dynamic market effectively.