Introduction

Enbridge Inc. is one of the largest energy infrastructure companies in North America, primarily focused on the transportation of crude oil and natural gas. With its extensive pipeline network, Enbridge plays a critical role in the energy market, making its stock a significant choice for investors. As of 2023, fluctuations in energy prices and regulatory changes have prompted analysts to closely watch Enbridge stock, making its performance relevant for both seasoned traders and new investors alike.

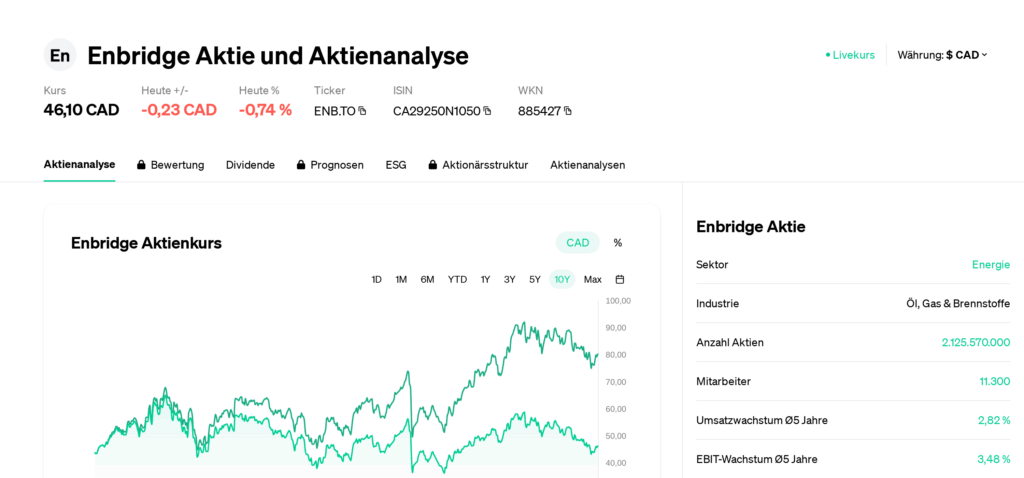

Current Performance and Trends

As of October 2023, Enbridge stock has shown resilience despite broader market volatility. The stock is trading around $45 CAD, marking a year-to-date increase of approximately 8%. This increase is attributed to rising crude oil prices and strategic expansions in renewable energy projects. Enbridge recently announced a successful completion of its Line 3 Replacement Project, which is expected to enhance its capacity and operational efficiency significantly. Analysts note that this project, along with the company’s commitment to investing in new technologies, positions Enbridge well in a transitioning energy market.

Dividend Perspective

Another attractive aspect of Enbridge stock is its consistent dividend payout. The company has a strong track record of raising its dividends, with a current yield of around 7.3%, making it particularly appealing to income-focused investors. According to the company’s Q3 earnings report, Enbridge’s financials continue to support dividend growth, with an expected increase set for early next year following solid cash flow generation.

Outlook and Future Significance

Looking forward, analysts remain cautiously optimistic about Enbridge stock. The company’s strategic investments in renewable energy and ongoing commitments to sustainability align with global demands for cleaner energy sources. As companies worldwide address climate change initiatives, Enbridge is adapting its portfolio to include more renewable projects, which could bolster its stock value in the coming years.

Conclusion

In summary, Enbridge stock remains a focal point for investors due to its strong market position, attractive dividends, and proactive approach to integrating renewable energy. As the energy sector continues to evolve, keeping an eye on Enbridge and its developments is essential, especially for those looking to invest in a company that balances traditional energy and sustainable practices. With an estimated stable growth rate, Enbridge is likely to stay on the radar of investors looking for both stability and environmental accountability.