Introduction: The Significance of Powell’s Speech

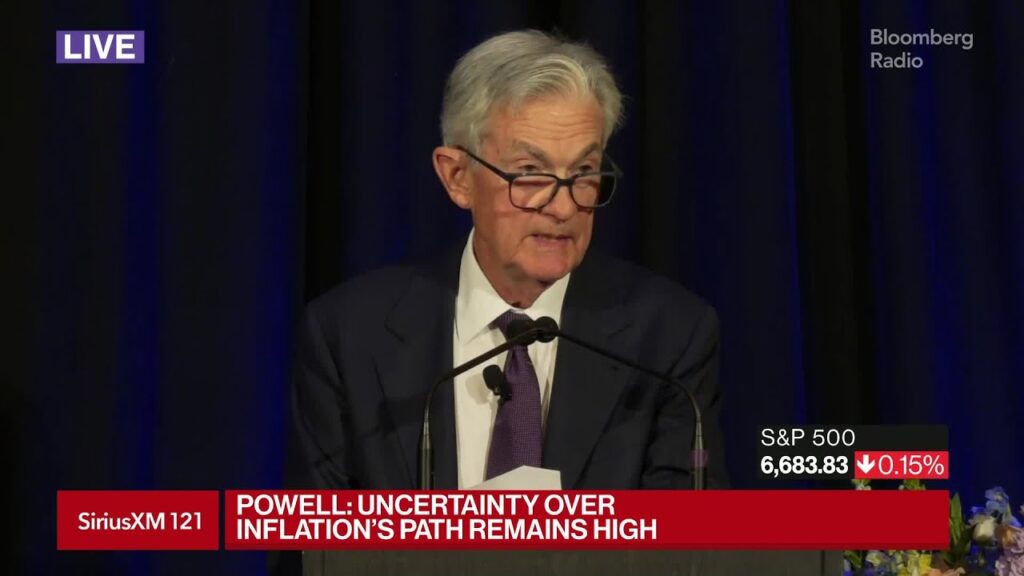

Federal Reserve Chair Jerome Powell’s speeches carry substantial weight in financial markets and economic policy discussions. His recent address, delivered on [insert date], provided crucial insights into the Fed’s stance on interest rates and inflation. Understanding these perspectives is vital for investors, policymakers, and the general public navigating a fluctuating economic landscape.

Main Body: Key Takeaways from the Speech

During his speech, Powell emphasized the Fed’s commitment to controlling inflation, which has remained persistently above the central bank’s target rate of 2%. He noted that despite recent signs of economic slowdown, inflationary pressures remain a significant concern, prompting the Fed to adopt a cautious approach to monetary policy.

Powell highlighted the importance of data in shaping future rate decisions, stating that the Fed would remain flexible, adjusting its monetary strategy based on upcoming economic indicators. This approach gives the Fed the ability to respond to unforeseen changes in the economy, which could be influenced by factors like global events, energy prices, and labor market conditions.

Additionally, Powell addressed the Fed’s dual mandate of promoting maximum employment and stable prices. He expressed optimism regarding the job market, indicating that employment levels have shown resilience despite the economic headwinds. However, he warned that any significant policy shifts would depend on further assessments of both inflation and employment trends.

Conclusion: Implications for the Future

Powell’s recent speech serves as a clarion call for market participants to remain vigilant. As the economic landscape continues to evolve, the Fed’s actions and communications will be critical indicators of future economic direction. Investors should brace for potential volatility in response to the Fed’s evolving policy stance. Furthermore, citizens should stay informed about how monetary policy decisions may impact their finances, particularly in terms of borrowing costs and savings interest rates. The ongoing dialogue about inflation and rates will undoubtedly shape the trajectory of the U.S. economy in the near future.