Introduction

Gold stocks on the Toronto Stock Exchange (TSX) have garnered significant attention in recent months due to fluctuating gold prices and global economic uncertainties. As inflation concerns and geopolitical tensions rise, investors are increasingly turning to precious metals as a safe haven. This article explores the current state of gold stocks on the TSX, recent trends, and what they mean for investors.

Market Trends

As of October 2023, gold prices have experienced notable volatility, recently trading around CAD 2,600 per ounce. These fluctuations have had a direct impact on gold mining stocks listed on the TSX, influencing both individual stock performances and the broader market. Mining companies such as Barrick Gold and Yamana Gold have shown resilience, with their stock prices responding positively amid uncertainties.

In Q3 2023, an uptick in demand for safe-haven assets has resulted in numerous gold companies reporting impressive earnings. According to a recent report by the TSX, many of these companies have outperformed the broader market index, showcasing a growing interest from institutional and retail investors alike. Analysts attribute this trend to bullish sentiment regarding gold’s role in hedging against inflation and currency devaluation.

Key Performers

Investors looking into TSX-listed gold stocks should pay close attention to key players in the sector. Companies like Agnico Eagle Mines and Kirkland Lake Gold have reported strong quarterly earnings, driven by high operational efficiency and robust gold output. Conversely, some smaller mining companies have faced challenges due to rising operational costs and exploration challenges, which have impacted their stock valuations.

Future Outlook

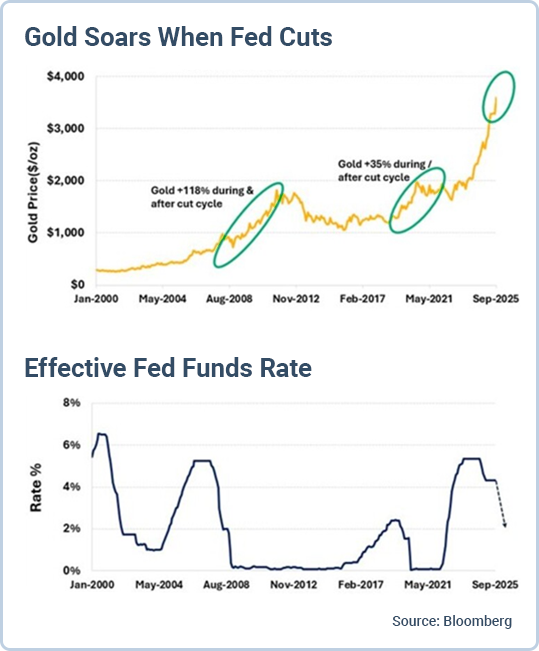

Experts predict that the demand for gold stocks will continue to grow as various economic indicators suggest that inflation may persist, keeping gold prices elevated. In the coming months, market analysts will be closely monitoring key factors such as global interest rates, mining production levels, and potential geopolitical events that could further influence investor sentiment toward gold. Investors are advised to remain cautious but optimistic, considering the current trends and the historical resilience of gold as a store of value.

Conclusion

In summary, gold stocks on the TSX are currently experiencing a wave of interest as factors like inflation and geopolitical uncertainties drive demand for safe-haven assets. While some stocks are thriving and exhibiting strong growth, others are facing challenges. Investors should weigh their options carefully, staying informed on market developments and expert analyses. As always, diversification and informed decision-making remain crucial in navigating the investment landscape.