Introduction

General Motors (GM) stock has been a topic of interest for investors, especially considering the shifts in the automotive industry towards electric vehicles (EVs) and sustainable practices. As one of the largest automakers in the world, GM’s stock performance reflects not only its corporate strategies but also broader economic trends. Understanding the factors influencing GM stock is crucial for potential investors and market analysts alike.

Recent Performance

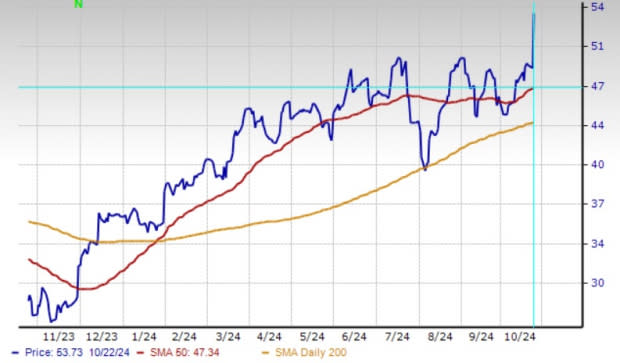

As of October 2023, GM stock has been experiencing fluctuations due to various internal and external factors. The company’s recent quarterly earnings report showed a revenue increase of 12% compared to last year, primarily driven by robust sales in EV models and a rebound in consumer demand post-pandemic. Analysts have noted that GM is investing heavily in its electric vehicle line, with plans to release new models aimed at capturing the growing EV market.

Despite these positive indicators, GM stock faced significant pressure from global supply chain issues, primarily semiconductor shortages and rising raw material costs. These challenges have affected production efficiency and ultimately impacted stock prices, which have seen volatility with a current trading range around $36 to $40 per share.

Market Trends and Influences

In addition to company-specific issues, GM stock is influenced by broader market trends. The automotive sector is undergoing a seismic shift towards greener technologies, which presents both opportunities and challenges. Competing automakers such as Tesla, Ford, and traditional brands entering the EV market increase competition and could affect GM’s market share.

Moreover, external factors such as interest rate changes, inflation, and consumer confidence play critical roles in market movements. In October 2023, rising interest rates have raised concerns about consumer spending, particularly in high-ticket items like cars, which could further impact GM’s stock performance.

Conclusion and Outlook

Looking ahead, analysts are cautiously optimistic about GM stock. The company’s commitment to an EV future, coupled with its initiatives on sustainable manufacturing and operational efficiency, positions it well for long-term growth. Experts believe that if GM successfully navigates supply chain challenges and capitalizes on the EV demand surge, it could see significant stock appreciation. However, investors are advised to monitor market conditions closely, as economic uncertainty could influence stock performance in the coming months.