Understanding LIDR Stock and Its Market Importance

LIDR stock, associated with the company LiDAR Technologies, has become a focal point for investors and analysts in the technology sector, especially as sectors like autonomous vehicles and advanced mapping gain momentum. The significance of LIDR stock lies in its representation of innovative technologies that are rapidly shaping the future of transportation and environmental monitoring.

Recent Developments in LIDR Stock

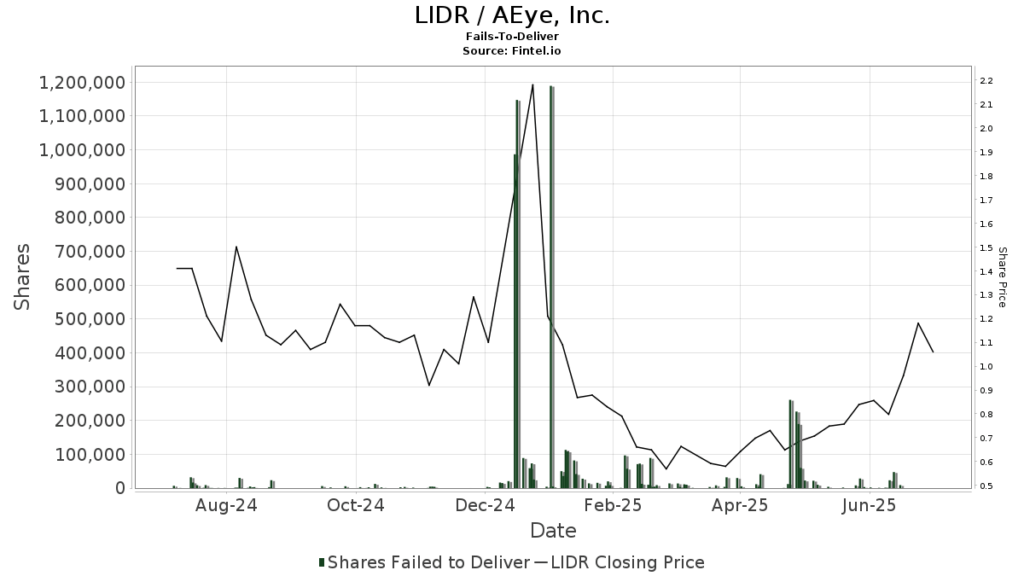

As of October 2023, LIDR stock has shown substantial volatility, reflecting broader market trends and the company’s recent announcements. In September, LiDAR Technologies reported a breakthrough in its sensor capabilities, enhancing precision while reducing costs. This announcement spurred a positive investor response, driving the stock price up by approximately 15% in just a few trading days.

Furthermore, the company has secured several contracts with major automotive manufacturers, effectively positioning itself as a critical player in the autonomous vehicle landscape, where accurate LiDAR systems are essential for safety and navigation.

Market Trends Impacting LIDR Stock

The increasing demand for advanced driver-assistance systems (ADAS) and full self-driving technologies has been a vital factor influencing LIDR stock performance. Analysts expect that by 2025, the global market for LiDAR in automotive applications alone could surpass $4 billion, driving further investment and innovation in the field.

Additionally, the growing emphasis on environmental monitoring and 3D modeling in various industries is propelling advancements in LiDAR technology, suggesting that LIDR stock may continue to benefit from diverse applications beyond transportation.

Conclusion and Future Outlook

In conclusion, LIDR stock represents both an opportunity and a risk for investors as the technologies it supports evolve rapidly. While the recent announcements and market trends are promising, potential investors should remain cautious due to market volatility and external factors such as regulatory changes and economic shifts. The future of LIDR stock appears bright, but it will be crucial to monitor technological advancements and market dynamics in the upcoming months. Investors should consider their own risk tolerance and stay informed about developments within both the company and the broader technology sector.