The Significance of Ethereum in the Crypto Market

Ethereum, the second-largest cryptocurrency by market capitalization, plays a vital role in the broader cryptocurrency ecosystem. With its unique smart contract functionality and a wide range of decentralized applications (dApps), Ethereum’s price trends are influential for investors and developers alike. Understanding Ethereum’s price dynamics is essential not only for crypto enthusiasts but also for traditional investors considering allocating resources to digital assets.

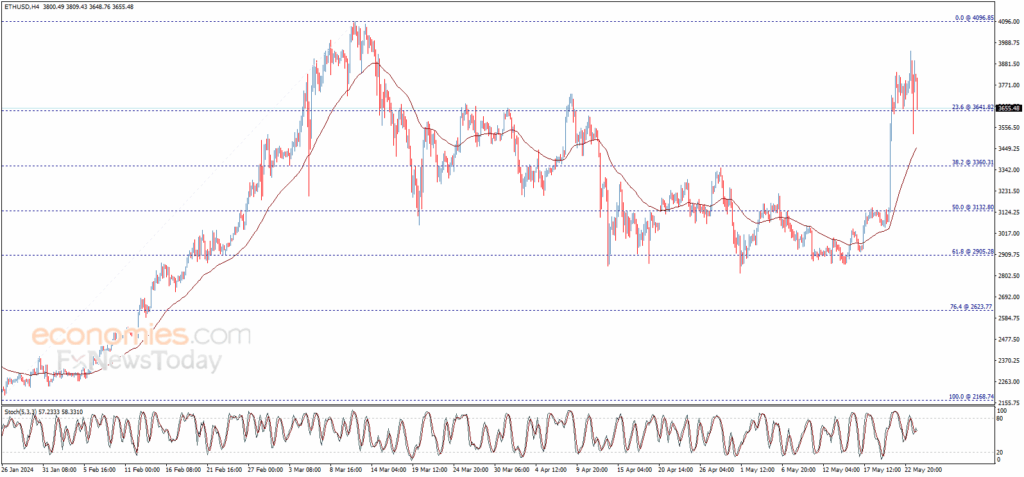

Current Price Trends and Market Analysis

As of October 2023, Ethereum’s price has witnessed significant fluctuations, reflecting changes in both market sentiment and macroeconomic factors. At the beginning of October, Ethereum was trading around CAD 2,100. However, in the following weeks, it reached highs of approximately CAD 2,500, primarily driven by increased interest in decentralized finance (DeFi) projects and the launch of Ethereum 2.0 features.

Experts attribute the recent price surge to a rise in institutional investment, alongside heightened scarcity as the Ethereum blockchain transitions to proof-of-stake, reducing the rate of new coin issuance. Additionally, the anticipation surrounding major Ethereum updates, such as EIP-4844, adds to the excitement and optimism in the community.

Factors Influencing Ethereum’s Price

Several factors are currently influencing Ethereum’s price. Firstly, the broader economic environment, including inflation rates and interest from institutional investors, plays a critical role. Regulatory news also affects market confidence; as governments around the world develop frameworks for digital currencies, clarity in regulation may either boost or impede Ethereum’s adoption.

Furthermore, the on-going competition from other smart contract platforms, such as Binance Smart Chain and Solana, creates pressure on Ethereum to maintain its leading position. Market analysts emphasize the need for Ethereum to enhance its scalability and reduce transaction fees to retain users and developers.

Looking Ahead: Future Price Forecasts

Looking forward, analysts are divided on Ethereum’s price predictions. Some believe Ethereum could hit CAD 3,000 by the end of 2023, driven by continued innovation and integration into mainstream finance. Others caution against potential pullbacks, citing historical volatility and the unpredictability of market sentiment.

As Ethereum continues to evolve, keeping abreast of market trends and updates is crucial for investors. Whether bullish or bearish, understanding the underlying factors influencing Ethereum’s price will equip stakeholders to make informed decisions in this dynamic landscape.

Conclusion

The cryptocurrency market remains inherently volatile, but Ethereum’s unique value proposition positions it as a key player in the digital currency space. By staying informed about price movements and market influences, investors can navigate the fluctuations of Ethereum’s price effectively, aiming for strategic investment rather than reactionary trading.