The Importance of the Toronto Housing Market

As one of Canada’s largest and most populous cities, the Toronto housing market plays a crucial role in the national economy. Significant shifts in this market not only affect local residents but can have ripple effects throughout the country. Understanding the trends and dynamics of this market is vital for potential buyers, investors, and policymakers alike.

Current State of the Toronto Housing Market

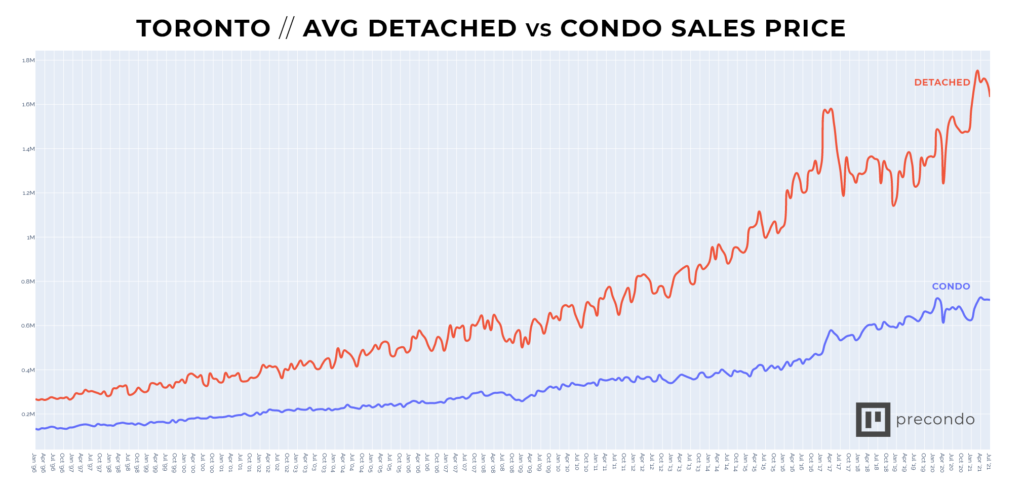

In 2023, the Toronto housing market has encountered a notable mix of challenges and opportunities. Following a surge in prices during the pandemic years, recent data shows that the market is adjusting. According to the Toronto Regional Real Estate Board (TRREB), the average home price in the Greater Toronto Area (GTA) is currently around $1.1 million, reflecting a slight decrease from the previous year’s highs.

Factors contributing to these changes include rising interest rates, which have increased borrowing costs for potential homeowners. The Bank of Canada raised its benchmark interest rate multiple times over the past year to combat inflation, resulting in a cooling effect on the housing market. The number of home sales is down approximately 20% compared to 2022, signaling a shift in buyer sentiment as affordability becomes increasingly challenging.

Rental Market Dynamics

While sales have cooled, the rental market is experiencing a different trend. Demand for rental properties in Toronto remains strong, driven by ongoing immigration and a steady influx of students returning to the city post-pandemic. The average monthly rent for a one-bedroom apartment in Toronto has surged to around $2,500, an increase of nearly 15% year-over-year. This spike highlights the urgency of addressing housing supply issues, which have become a focal point in municipal and provincial discussions.

Future Predictions for the Toronto Housing Market

Looking ahead, experts are cautiously optimistic about the Toronto housing market. While the rising interest rates are expected to keep a lid on housing price growth, many analysts believe that the market will stabilize rather than decline significantly. Investors may see opportunities in pockets of the city where prices lag behind overall market trends.

Additionally, government initiatives aimed at increasing housing supply and affordability may begin to bear fruit, potentially relieving some of the pressure on the market. These may include measures like enhancing zoning regulations to allow for more multi-family housing developments and promoting affordable housing projects.

Conclusion

In conclusion, the Toronto housing market is navigating a period of adjustment in 2023, marked by shifts in home sales and rental prices. For residents and investors, keeping an eye on these trends will be crucial for informed decision-making in the increasingly complex landscape of Toronto real estate.