Importance of the S&P 500

The S&P 500 is one of the most widely recognized stock market indices in the world. Composed of 500 of the largest publicly traded companies in the United States, it serves as a benchmark for the overall health of the U.S. economy and stock market. Investors and analysts closely monitor its performance to gauge economic trends, making it a crucial barometer for market sentiment.

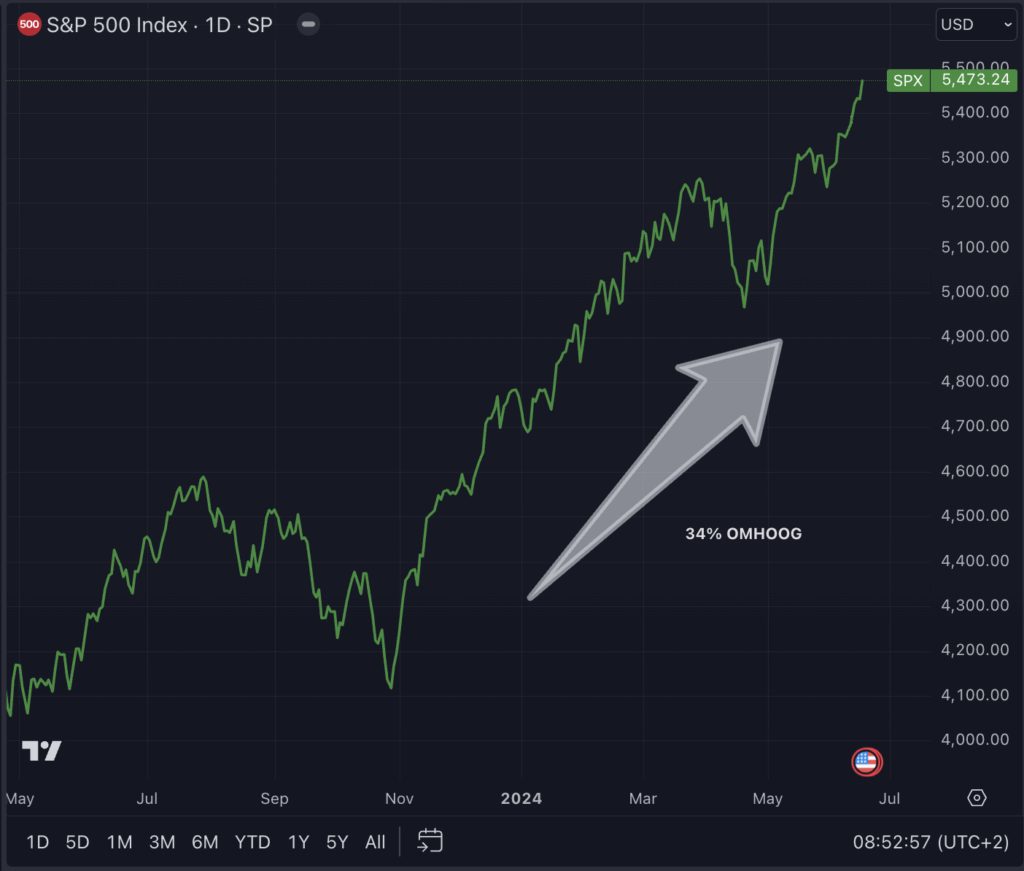

Recent Trends

As of October 2023, the S&P 500 index has shown remarkable resilience amidst prevailing economic uncertainties, including inflationary pressures and fluctuating interest rates. Over the past quarter, the S&P 500 has seen an avg. increase of 8%, driven largely by strong earnings reports from key technology and healthcare sectors.

Notably, AI-driven companies have surged, with major players like Microsoft and Alphabet leading the charge due to their substantial investments in artificial intelligence. This trend is reflected in the tech-heavy NASDAQ composite, which has also seen significant gains, suggesting a bullish phase for technology stocks.

Economic Factors Influencing the S&P 500

Several economic factors are influencing the index’s performance. The Federal Reserve’s recent comments on interest rates suggest a cautious approach toward further rate hikes, contributing to market optimism. Additionally, signs of a stabilizing economy, coupled with moderate inflation rates, have encouraged investors.

Moreover, consumer sentiment remains relatively strong, driven by low unemployment rates and wage growth. Such factors contribute to consumer spending, vital for growth, providing further support for stock prices especially in retail and service sectors.

Conclusion: What Lies Ahead for Investors

Looking ahead, analysts predict continued volatility in the S&P 500 as external factors, including geopolitical tensions and potential Federal Reserve adjustments to monetary policy, could impact stock performance. However, many experts remain optimistic regarding the index’s long-term trajectory, especially if corporate earnings continue to outperform expectations.

For investors, staying informed on market trends and maintaining a diversified portfolio remains crucial. Continuous monitoring of economic indicators and global events that may affect the S&P 500 will be paramount in navigating future market conditions.