Introduction

The Oracle Corporation has been a significant player in the technology sector, providing cloud services and software that support businesses around the world. As interest in cloud computing and data management continues to rise, the performance of Oracle’s stock price is of particular relevance to investors and analysts alike. Understanding the factors that influence Oracle’s stock can provide insight into broader market trends as well.

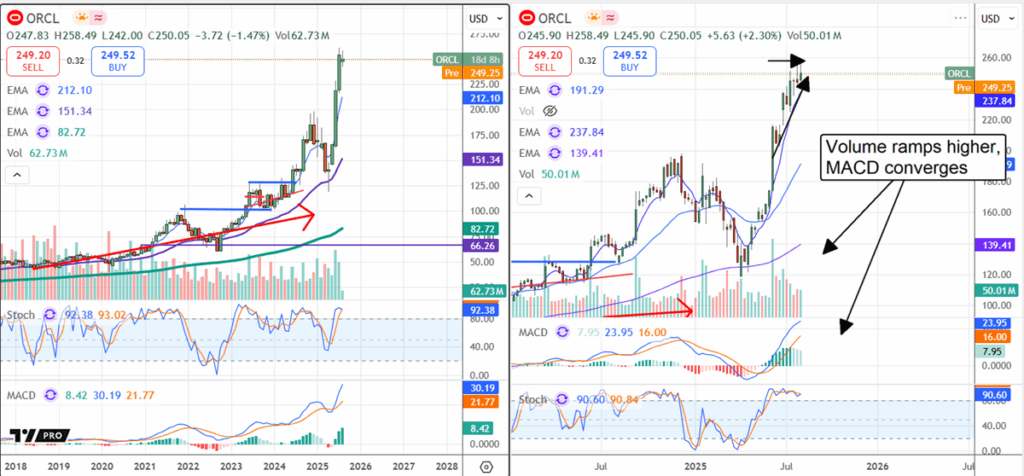

Oracle’s Recent Stock Performance

As of October 2023, Oracle’s stock has seen notable fluctuations, reaching a peak price of approximately CAD 106 per share. Factors driving this change include quarterly earnings reports, changes in cloud service demand, and competitive pressures from other tech giants like Microsoft and Amazon. Following its latest earnings release, Oracle reported a year-over-year revenue growth of 18%, driven largely by its cloud infrastructure and applications segment.

Market Response and Analyst Predictions

Market analysts have mixed sentiments regarding Oracle’s future stock performance. Some analysts foresee continued growth, projecting that the stock could climb towards CAD 120 by early 2024, particularly if cloud adoption rates remain high. Others cite potential risks, such as increasing competition and global economic challenges, which may hinder growth and put downward pressure on the stock price.

Conclusion

The performance of Oracle’s stock price is expected to remain a focal point for investors. As the company continues to adapt to market demands and innovate its offerings, staying updated on Oracle’s developments will be crucial for making informed investment decisions. With the anticipated growth in the tech sector, Oracle’s stock might present opportunities, but potential investors should weigh the associated risks. As always, thorough market analysis and consultation with financial advisors are recommended when navigating the stock market.