Introduction

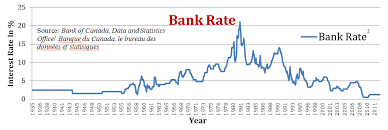

Canadian bank interest rates are a defining component of the country’s economic landscape, influencing not only consumer borrowing but also savings, investments, and overall economic growth. As the Bank of Canada adjusts its monetary policy in response to economic conditions, ordinary Canadians are feeling the effects of these changes in their daily financial lives.

Recent Trends

As of October 2023, the Bank of Canada has maintained its benchmark interest rate at 5.00%, up from historic lows in recent years aimed at combating inflation. This decision comes after a series of rate hikes aimed at managing rapid price increases across various sectors. The rising rates have had a direct effect on borrowing costs for mortgages and personal loans, making borrowing more expensive for Canadians.

Increased interest rates have led to higher fixed and variable mortgage rates. For example, the average five-year fixed mortgage rate now sits around 5.68%, causing many potential homeowners to reconsider their plans. Experts predict that this trend may continue if inflation remains above the Bank’s target of 2%.

Impact on Consumers

The increase in interest rates has sparked considerable discussion among Canadians regarding their personal finances. Many consumers have reported feeling squeezed by higher mortgage payments, leading to a notable rise in demand for financial advice. Some analysts suggest that Canadians should prioritize paying down high-interest debts and consider refinancing options where beneficial.

Furthermore, with the impact on savings, Canadians seeking to increase their savings interest are now looking at high-interest savings accounts that offer competitive rates due to the rising benchmark. This presents an opportunity for savers, as many institutions are now providing more attractive rates to lure in depositors.

Conclusion

The current landscape of Canadian bank interest rates is a crucial topic for consumers to monitor closely, as these rates directly influence economic conditions, financial decisions, and overall market dynamics. With inflation pressures persisting, it is anticipated that rate adjustments will continue in the near future. Canadians should stay informed and explore financial strategies that will help them navigate this shifting environment successfully. Understanding the implications of rising interest rates and adapting financial practices will be vital for consumers in the coming months.