Introduction

Celestica Inc., a leading provider of supply chain solutions and electronics manufacturing services, has captured the attention of investors as it navigates a tumultuous market landscape. The importance of closely following Celestica stock is underscored by its role in various high-tech sectors, including telecommunications, cloud computing, and automotive systems. With the ongoing trends in technology and global supply chain dynamics, understanding how these factors affect Celestica’s stock performance is crucial for potential investors.

Recent Developments

As of October 2023, Celestica’s stock has seen considerable volatility, recently trading at approximately $13.50, which represents a slight decline from previous highs earlier in the year. Factors influencing this recent performance include fluctuations in demand for electronic components and a renewed focus on sustainable manufacturing practices. Furthermore, Celestica reported its Q3 earnings, showcasing a revenue increase of 8% year-over-year, bolstered by strong contributions from its manufacturing segment. Analysts noted that Celestica’s expansion in the electric vehicle supply market and partnerships with major tech companies have fueled growth prospects.

Market Analysis

Market experts suggest that Celestica’s focus on innovation and adapting to customer needs positions it well against competitors. A report from a leading investment firm highlighted a positive outlook on the stock due to projected increases in technology spending. According to data from Statista, global IT spending is expected to grow by 5% in 2024, which would benefit companies like Celestica involved in electronics manufacturing.

Investor Outlook

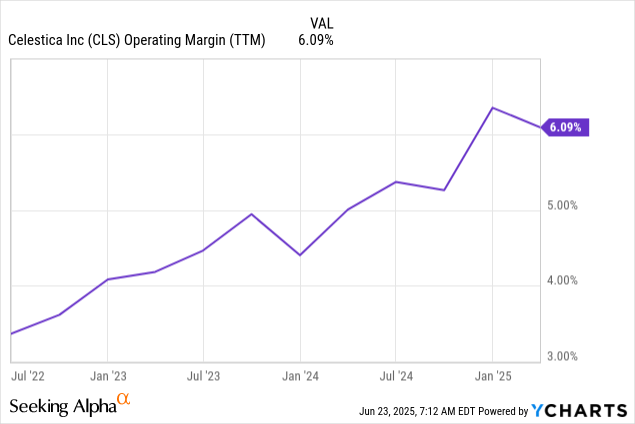

Looking forward, analysts are divided on the short-term outlook for Celestica stock. Some suggest a cautious approach, as macroeconomic challenges such as inflation and rising interest rates could impact consumer electronics demand. Others emphasize confidence in Celestica’s strategic initiatives aimed at diversifying its service offerings and improving operational efficiency. The company’s forward P/E ratio of 10 implies a valuation that could be attractive to value investors.

Conclusion

As Celestica continues to evolve with market demands, investors will need to remain vigilant in assessing related market indicators and company performance metrics. While the stock has its share of risks, the long-term potential places Celestica in a compelling position within the technology landscape. Current investors may want to monitor upcoming quarterly results and global supply chain developments closely, while new investors should consider the stock’s potential trajectory amid increasing technology expenditure.