Introduction

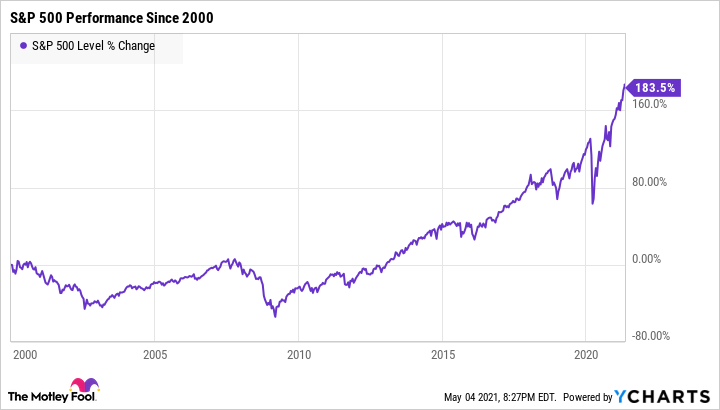

The S&P 500 index is a bellwether for the U.S. equity market, representing the stock performance of 500 of the largest publicly traded companies in the United States. As one of the most widely followed stock market indices globally, it provides a reliable indicator of overall market health and economic conditions. Understanding the current state of the S&P 500 is crucial for investors and market participants as it profoundly impacts financial decisions and retirement portfolios.

Recent Performance and Trends

As of October 2023, the S&P 500 has shown a remarkable resilience following the volatility of the previous year, which saw significant fluctuations due to inflation concerns and interest rate hikes by the Federal Reserve. In the third quarter of 2023, the index recorded gains, closing over 4,400 points, which marks a recovery from the lows experienced early in 2022.

Technology stocks have driven much of this uptick, with major players like Apple, Microsoft, and Amazon contributing substantial gains. Additionally, consumer discretionary and healthcare sectors have also seen notable performance, with several companies reporting strong earnings that exceeded analyst expectations. The recent surge in artificial intelligence investments has particularly bolstered tech stocks, signaling a shift towards innovation-driven growth.

Potential Challenges Ahead

Despite the optimistic outlook, analysts warn of potential headwinds. Rising interest rates are expected to continue influencing the market, with the Federal Reserve indicating a likely pause in rate hikes. Moreover, geopolitical tensions, supply chain disruptions, and potential recessionary fears could pose risks to sustained growth.

Conclusion

Looking ahead, the S&P 500 remains a focal point for both investors and economists. The current trends suggest that while there are positive signals in various sectors, caution remains necessary due to macroeconomic and geopolitical uncertainties. Investors are encouraged to closely monitor the index as it offers critical insights into future market movements and economic health. With ongoing discussions regarding interest rates and economic policies in the near future, the S&P 500’s trajectory will be vital for understanding the broader financial landscape.