Introduction

As one of the largest tech giants in the world, Google’s parent company, Alphabet Inc. (GOOGL), plays a significant role in the stock market. The importance of tracking Google stock lies not only in its direct impact on investors but also on the overall tech sector, which has seen unprecedented growth over the past decade. Investors and analysts alike watch GOOGL closely to understand market trends, as it is often viewed as a bellwether for the technology industry.

Current Performance

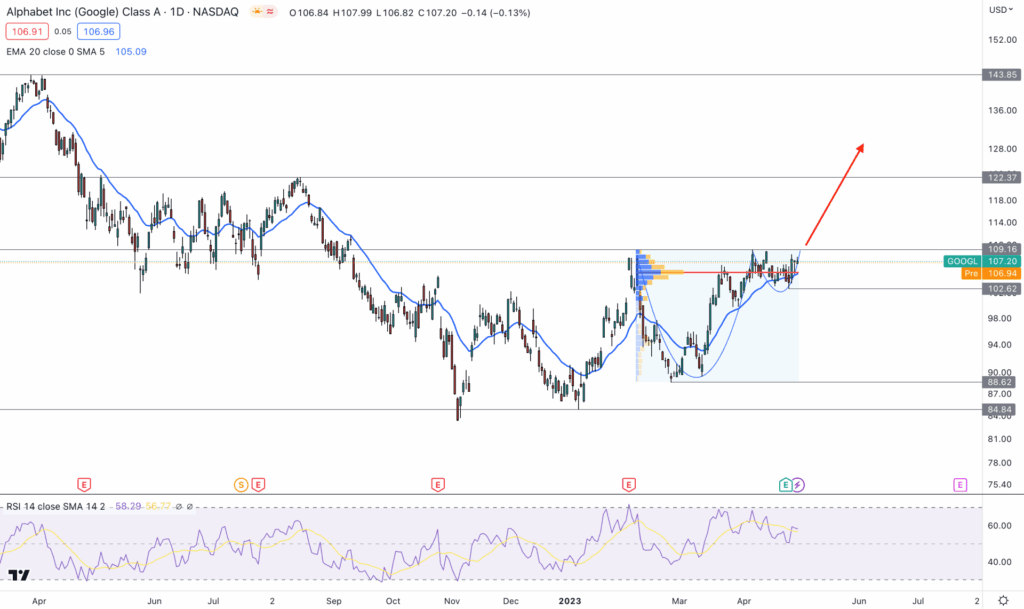

As of October 2023, Google stock has exhibited notable price fluctuations, primarily driven by broader economic conditions, regulatory scrutiny, and competition in the digital advertising space. In late September, GOOGL’s share price hovered around $135 per share, representing a 10% increase from earlier this year. Analysts attribute this rise to a strong earnings report for Q2 2023, where the company reported a revenue increase of 12% year-over-year, bolstered by growth in its cloud services and YouTube advertising revenues.

Market Influences

The stock’s volatility can be partly explained by ongoing concerns regarding antitrust regulations and data privacy, both of which have been hot topics in the industry. Recent news suggests that the U.S. Federal Trade Commission may impose stricter regulations on large tech firms, which has led to uncertainty among investors. Despite these challenges, experts remain optimistic about Google’s long-term growth potential, citing its innovative initiatives in artificial intelligence and expanding cloud services as key drivers for future revenue.

Analysis and Forecast

Market analysts are cautiously optimistic about the future of Google stock. According to a recent consensus among stock analysts, the average price target for GOOGL is set at approximately $150 per share by the end of 2024, reflecting a potential upside for investors. Factors that could contribute to this growth include a rebound in digital advertising as post-pandemic spending increases, and further integration of AI across its product lines, which could enhance user engagement and generate new revenue streams. Additionally, sustained growth in the cloud computing segment is expected to solidify Google’s position as a leader in technology.

Conclusion

In conclusion, Google stock remains a focal point for investors, given its significant impact on the tech sector and overall market performance. While external challenges such as regulation and competition exist, the company’s continuous innovation and adaptability suggest a promising outlook. For potential investors, monitoring GOOGL’s performance and understanding market dynamics will be crucial in making informed investment decisions.