Introduction

The stock of BlackBerry Limited (NYSE: BB), a Canadian cybersecurity and software company, has been a subject of considerable interest recently. With a history of highs and lows, investors are closely monitoring BlackBerry’s stock performance as the company navigates its transformation from hardware to software and cybersecurity solutions. Understanding the trends and factors affecting its stock is crucial for investors who want to make informed decisions.

Recent Performance

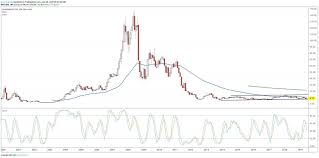

As of October 2023, BlackBerry’s stock price has experienced fluctuations that reflect both market conditions and company performance. After reaching a peak in early 2021, the stock has seen a decline, with prices hovering around $4.00 per share. Analysts attribute this decline to various factors, including competitive pressures in the cybersecurity space and ongoing challenges in shifting the company’s business model. In recent earnings reports, BlackBerry reported a year-over-year decline in revenue, primarily driven by its transition away from legacy products. However, there have been notable developments in the software segment, including strategic partnerships and contract wins that may positively influence future earnings.

Market Insights

Investment analysts are divided in their outlook on BlackBerry stock. Some analysts see potential for growth, particularly as the global demand for cybersecurity solutions increases. The rise in remote work and digital transformation initiatives among enterprises has sparked greater interest in BlackBerry’s offerings. On the other hand, skeptics point to the company’s historical challenges and market volatility as reasons for caution. Investment firms are closely monitoring shifts in management strategy and execution of product innovations as indicators of future performance.

Conclusion

As BlackBerry continues to pivot towards software and cybersecurity solutions, the trajectory of its stock remains uncertain but potentially promising. Investors should stay informed about quarterly earnings, technological advancements, and market positioning, as these elements will significantly impact BlackBerry’s stock performance. The company’s ability to adapt to the dynamic market landscape will determine its future, making it a key watchpoint for stock market participants. With cybersecurity becoming an indispensable aspect of business, BlackBerry may still play a pivotal role in the industry, but how it translates that potential into stock valuation remains to be seen.