Introduction to NBIS Stock

NBIS stock, traded under Neurobiogen Inc., is rapidly gaining attention in the biotechnology sector as it focuses on innovative approaches for treating neurological disorders. As we progress through 2023, advancements in research, regulatory filings, and market dynamics particularly influence investor interest in NBIS. Understanding these factors is essential for investors and stakeholders looking to navigate the ever-evolving landscape of biotech investments.

Recent Developments Affecting NBIS Stock

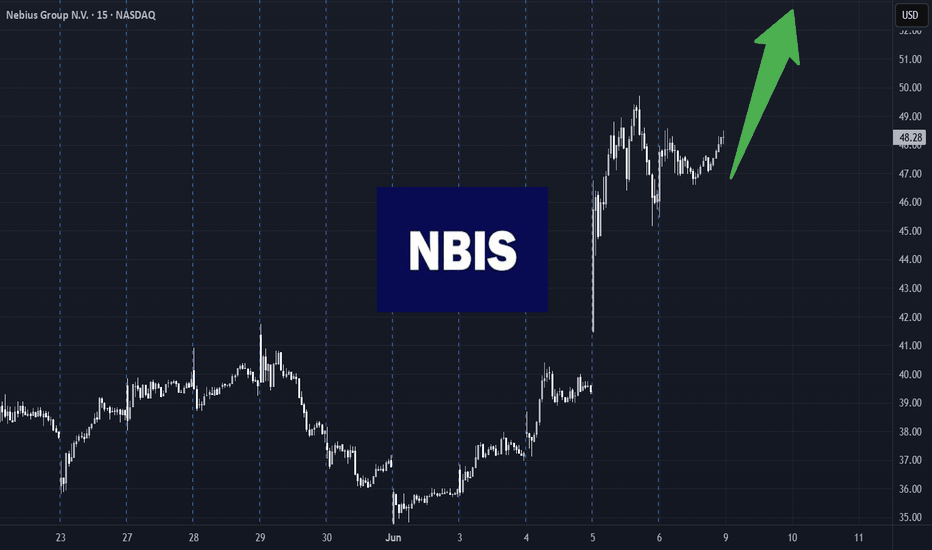

Throughout 2023, Neurobiogen Inc. has made significant strides in both product development and market presence. In recent months, the company announced promising results from its clinical trials aimed at treating Alzheimer’s Disease, which drove a 20% increase in stock price following the release of trial data. Furthermore, the acquisition of a key patent for a novel treatment methodology solidified NBIS’s position as a contender in the market.

Analysts have pointed out that the biotech sector remains quite volatile, with NTBS stock typically showing a strong correlation with clinical trial results and FDA announcements. The ongoing tension in global supply chains also impacts Neurobiogen’s production and distribution capabilities, a factor that investors should be mindful of.

Market Sentiment and Investor Outlook

Market sentiment surrounding NBIS stock has been mixed. While many analysts remain optimistic about the long-term potential due to innovative treatments in the pipeline, others highlight the risks associated with regulatory approvals and competition from established pharmaceutical companies. According to an August 2023 report by MarketWatch, NBIS stock has been rated as ‘Buy’ by 67% of analysts, who believe that the current stock valuation presents a buying opportunity for long-term investors.

The company’s ability to successfully commercialize its significant findings will be a determining factor for stock performance in the upcoming quarters. Key upcoming events include investor calls and presentations at biotechnology conferences, which are expected to offer insights into future growth and profitability.

Conclusion and Forecast

In summary, NBIS stock is at a critical juncture in its development. The combination of recent positive clinical outcomes, strategic partnerships, and market interest creates a promising outlook for investors. However, potential volatility remains an undeniable risk. As Neurobiogen continues to navigate regulatory landscapes and clinical trials, the stock’s performance will be a point of keen interest for both potential investors and current stakeholders.

For those tracking NBIS stock, staying updated on both clinical trial outcomes and macroeconomic factors will be essential in making informed investment decisions moving forward.