Introduction

The stock market often reflects the performance and stability of various financial institutions, and one of the key players in the Canadian banking sector is the Canadian Imperial Bank of Commerce (CIBC). Understanding CIBC’s stock performance is crucial for investors and stakeholders as it serves as a barometer for the Canadian financial landscape, particularly in the wake of economic changes caused by inflation and shifting interest rates.

CIBC Stock Performance Overview

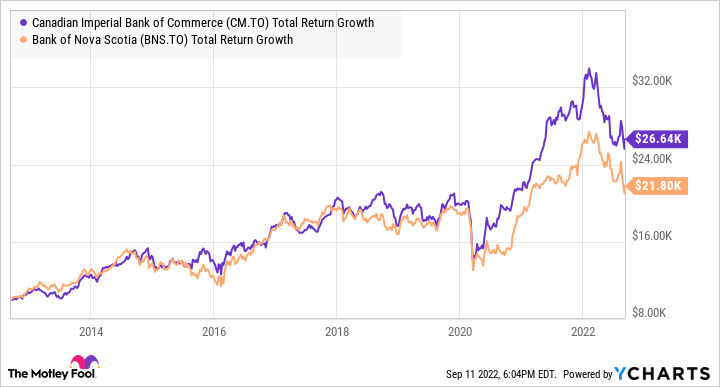

As of October 2023, CIBC stock has shown a resilient performance amid market fluctuations. Over the past months, stock prices have fluctuated but have generally trended upwards, reflecting an overall confidence in the bank’s financial health and operational strategies. Analysts report a significant uptick in CIBC’s market capitalization, which stands at approximately CAD 58 billion, positioning it as one of Canada’s largest banks.

Recent quarterly earnings reflected a revenue increase of 5% year-over-year, with a reported net income of CAD 1.5 billion for Q3 2023. The results were driven by an increase in net interest income, attributed mainly to rising interest rates. This growth is seen as a positive indicator for investors, suggesting that CIBC is effectively managing its assets in a high-rate environment.

Key Factors Influencing CIBC Stock

Several factors are influencing CIBC’s stock performance:

- Interest Rates: The Bank of Canada has indicated a cautious approach toward interest rates, which affects banks’ lending margins and profitability.

- Economic Outlook: The ongoing issues surrounding inflation and potential recessions have made investors wary; however, CIBC’s diversified services mitigate risk.

- Technological Advancements: CIBC has been investing significantly in digital banking services to enhance customer experiences, which may contribute positively to its stock in the long run.

Conclusion

As we move forward, CIBC stock is expected to remain a focal point for investors looking to capitalize on the recovering Canadian economy. Analysts suggest that maintaining a close watch on interest rate adjustments and the bank’s continued focus on technology and customer service will provide crucial insights into its stock performance. While uncertainties remain in the financial markets, CIBC’s robust position and strategic initiatives appear to create optimism around its future growth and stock value.