Introduction

The rise of digital banking has brought various fintech companies into the spotlight, among which Chime stands out as a notable player. As a mobile banking platform, Chime has gained significant user traction and recently made headlines concerning speculative discussions about its upcoming stock listings. Understanding Chime stock is essential for investors looking for emerging trends in the fintech sector.

Current State of Chime

Founded in 2013, Chime has transformed how consumers view banking by offering fee-free transaction accounts and financial management tools. As of late 2023, the company has reported over 14 million active users, demonstrating a robust customer base. Recent financial reports suggest that Chime operated with a revenue of approximately $300 million in 2022, solidifying its position as a significant competitor in the digital banking space.

Speculation Around Chime Stock

Rumors about a public listing have circulated, with some analysts predicting that Chime could file for an IPO as early as 2024. Such an IPO would allow investors to buy shares in the company, providing them with a chance to tap into the growing fintech market. Market observers note that anticipated financial projections show Chime potentially reaching revenues above $1 billion by 2025 if current growth trends continue. This speculation has led to a surge in interest surrounding Chime stock.

Investment Considerations

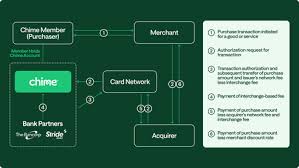

Investors expressing interest in Chime stock should consider several factors, including market competition, regulatory challenges, and the company’s operational model. With competitors like Robinhood and Cash App, Chime must continuously innovate and provide value to retain its user base. Moreover, as fintechs face increased regulatory scrutiny, it remains crucial to monitor how regulatory changes may impact Chime’s operations.

Conclusion

As Chime prepares to navigate the potential public offering landscape, understanding Chime stock becomes increasingly relevant for investors. The growing digitization of banking services and a shift in consumer preferences towards fintech solutions signal a promising future for companies like Chime. As the company solidifies its market position and aims for sustainable growth, it could emerge as a game-changer in the financial technology sector. Investors should stay informed about developments in Chime’s business and the broader fintech landscape to capture opportunities that may arise.