Introduction

BMO stock, representing the Bank of Montreal, remains a vital component in the Canadian banking sector and is a significant player in North American financial markets. Investors closely monitor BMO stock due to its historical stability, dividend performance, and potential growth opportunities. As of late 2023, understanding the factors influencing BMO’s stock price is essential for investors and market analysts alike.

Current Market Performance

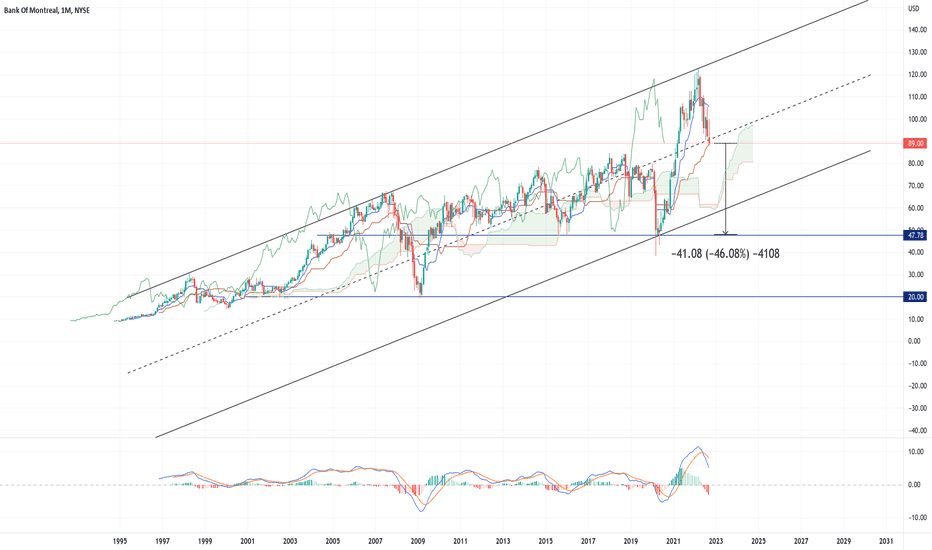

As of October 2023, BMO stock is trading at approximately CAD 140 per share, showing a steady increase of around 8% over the past year. This increase is attributed to several factors, including a rise in interest rates that has positively impacted bank profitability. The Bank of Montreal has been actively expanding its services and investing in technology, which has also contributed to its improved market position.

Recent earnings reports indicate that BMO’s net income rose by 12% in the latest quarter compared to the previous year, reflecting effective cost management and increased demand for loans and financial services. Analysts are optimistic about BMO’s growth prospects, especially as the Canadian economy continues to recover from the pandemic. Moreover, the bank’s commitment to sustainable finance and responsible lending practices has garnered attention from socially conscious investors.

Factors Influencing BMO Stock

Several key factors are currently influencing BMO’s stock performance:

- Interest Rates: The Bank of Canada’s recent monetary policy adjustments have implications for BMO and other financial institutions. Elevated interest rates have resulted in increased profit margins for banks.

- Regulatory Environment: Ongoing regulatory changes in the financial sector are critical for banks. BMO’s compliance and adaptability to new regulations will be pivotal in maintaining investor confidence.

- Market Competition: Competition among Canadian banks is intensifying, particularly with the rise of fintech companies. BMO’s ability to innovate and stay relevant in this competitive landscape will influence its stock performance.

Conclusion

In conclusion, BMO stock presents an intriguing opportunity for investors seeking stability and growth in the banking sector. The current market trends indicate a positive outlook, bolstered by favorable economic conditions and proactive management strategies. However, potential investors should remain vigilant regarding market shifts and economic indicators that could impact BMO’s financial health. As we move into 2024, analysts will continue to monitor BMO’s stock closely, particularly in light of changing interest rates and evolving market dynamics. Overall, the significance of BMO stock within the broader financial landscape cannot be overstated, making it a key consideration for both seasoned and novice investors.