Introduction

Baba stock, representing Alibaba Group Holding Ltd., has garnered significant attention among investors in recent months. As a frontrunner in the global e-commerce market, Alibaba’s performance is critical not just for its stakeholders, but also for the broader tech industry and international markets. With evolving economic conditions and regulatory challenges in China, understanding the current state and future trends of Baba stock is essential.

Recent Performance

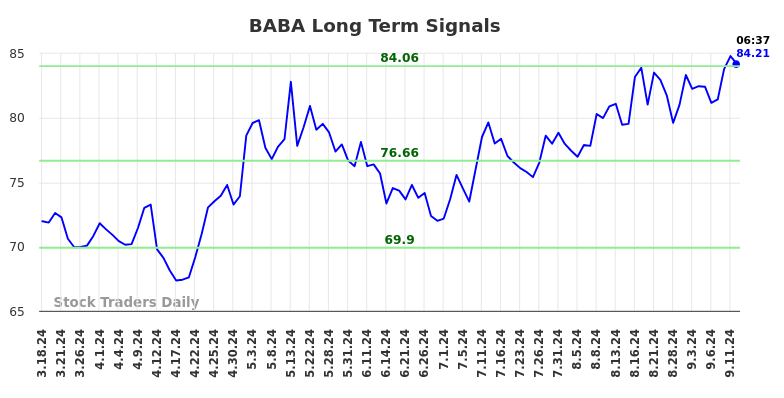

As of mid-October 2023, Baba stock has seen fluctuations influenced by various factors. After a rough 2022, where extensive regulatory scrutiny caused a downturn, the stock has begun to recover. In the past three months, there has been a noticeable rebound, with stocks rising approximately 30%. Analysts attribute this uptick to an improved outlook on China’s economic recovery post-COVID and a series of strategic changes within the company aimed at boosting investor confidence.

Market and Regulatory Context

Alibaba has made headlines recently with new initiatives aimed at gaining market share amid heightened competition from rivals like JD.com and Pinduoduo. Additionally, regulatory pressures from the Chinese government appear to be easing, which has positively influenced investor sentiment. However, challenges remain, as uncertainties in U.S.-China relations and ongoing geopolitical tensions can impact Alibaba’s operations and stock price. For example, recent sanctions against Chinese companies by the U.S. government still loom large, presenting potential risks for foreign investment.

Forecast and What Lies Ahead

Looking forward, many analysts paint a cautiously optimistic picture for Baba stock. While the company aims to diversify its revenue streams beyond e-commerce—venturing into cloud computing, digital media, and entertainment—investors are advised to remain vigilant. The stock is anticipated to experience further volatility as global economic indicators fluctuate. Financial analysts recommend keeping an eye on Alibaba’s quarterly earnings reports slated for late October, as these will provide critical insights into the company’s ongoing recovery efforts and future growth prospects.

Conclusion

Baba stock remains a significant focus for both individual and institutional investors. The recent uptick in stock price combined with an easing of regulatory pressures could suggest a period of potential growth for Alibaba Group. However, investors should consider the broader market context, including geopolitical tensions and consumer behavior in China. As always, comprehensive research and a clear understanding of the risks involved are crucial for making informed investment decisions.