Introduction

The performance of Apple Inc. (AAPL) stock has significant implications for investors and the wider technology market. As one of the world’s most valuable companies, any fluctuations in Apple’s stock can influence not only investor sentiment but also the overall stock market indices. In recent months, Apple stock has shown notable changes, prompting both analysts and investors to examine factors contributing to its current trajectory.

Recent Performance

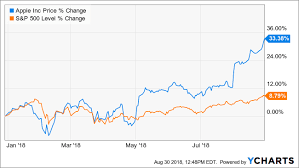

As of October 2023, Apple stock is trading near $175, reflecting a growth of over 10% since the beginning of the year. Analysts attribute this uptrend to several critical factors, including strong quarterly earnings, continued demand for the iPhone 15, and increased service revenue. In its last quarterly earnings report released in September 2023, Apple reported revenues of $81 billion, surpassing analysts’ expectations and showcasing a year-over-year increase of 8%. This growth is part of an overarching trend where Apple’s service sector continues to thrive, contributing significantly to overall revenue and profitability.

Market Reactions and Trends

The technology sector, in general, is witnessing a rebound as interest rates stabilize, and inflation shows signs of easing. Apple, seen as a bellwether for the tech industry, has benefited from this broad market recovery. Investors have reacted favorably, resulting in an increase in stock buybacks and dividends, which appeal to shareholders seeking income stability.

Moreover, analysts remain optimistic about Apple’s future as the company explores new avenues, including augmented reality (AR) technology. Rumours about an upcoming AR headset, potentially entering the market in late 2024, have also stirred investor enthusiasm, fueling further optimism about long-term growth prospects.

Conclusion

In conclusion, the trends observed in Apple stock throughout 2023 highlight the company’s resilience and innovative capabilities. As Apple continues to drive earnings through its product innovation and service expansion, investors are encouraged to stay informed about market developments. Looking ahead, maintaining focus on Apple’s strategic initiatives, including new technology ventures, will be crucial for projecting its stock performance. For investors, keeping a close eye on AAPL stock could reveal opportunities for growth, especially as global economic conditions evolve.