Introduction

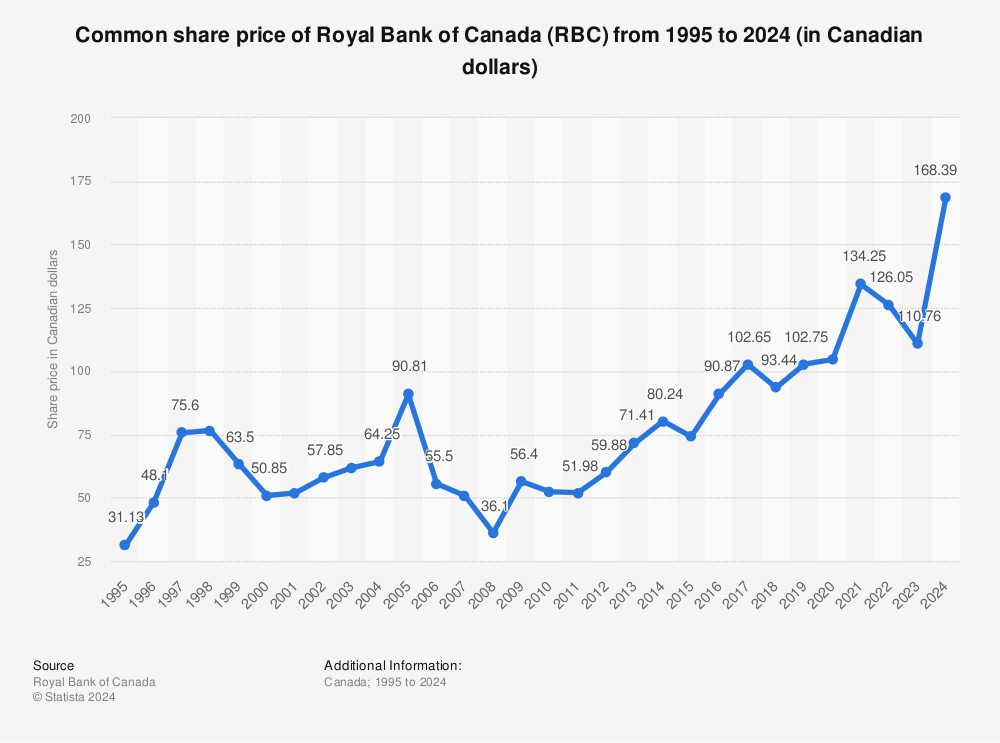

The Royal Bank of Canada (RBC) is one of the largest financial institutions in the country, and its stock is closely monitored by investors, analysts, and financial experts alike. Understanding the stock price of RBC is crucial as it reflects the bank’s performance, the health of the Canadian economy, and overall market sentiment.

Current Stock Price Trends

As of October 2023, RBC’s stock price stands at approximately CAD 130 per share, experiencing fluctuations based on various factors, including quarterly earnings reports, interest rate changes, and economic recovery prospects. In recent weeks, the stock has shown resilience amidst market volatility, partly due to strong consumer lending performance and an uptick in investment banking activities.

Factors Influencing RBC Stock Price

Several key elements influence the RBC stock price:

- Economic Indicators: Economic data such as GDP growth rates, unemployment rates, and consumer spending play a significant role in determining investor confidence and, consequently, the stock price.

- Interest Rates: The Bank of Canada’s interest rate decisions impact banks’ profitability, especially in lending and mortgage rates, which directly affect RBC’s earnings.

- Market News and Reports: Quarterly earnings results, mergers, acquisitions, and sector news can shift investor perceptions and lead to stock price changes.

Recent Developments

In September 2023, RBC reported a 10% year-over-year increase in profits, driven by higher net interest income. This positive news provided a boost to the stock price, reflecting investor optimism about the bank’s growth potential in a recovering economy.

Furthermore, CEO David McKay announced strategic initiatives aimed at enhancing digital services and expanding market reach. This focuses on innovation, which can increase profitability and market share, making RBC stock more attractive to investors.

Conclusion

The RBC stock price is not just a number; it is a barometer of the bank’s performance and an indicator of the broader economic landscape in Canada. As investors keep a close watch on economic indicators and corporate strategies, RBC is likely to continue making headlines in the financial markets. Analysts predict that if the current growth trends continue, RBC could experience a gradual increase in stock price over the next few quarters. Investors are advised to stay informed about market conditions and financial reports to understand the potential movements of RBC stock in the future.