Introduction

HIMS, a telehealth company focusing on men’s health and wellness, has gained significant attention in recent years. The company’s unique business model and innovative approach towards healthcare have caught the eyes of investors, making the performance of HIMS stock a hot topic in the market. Understanding the trends and factors influencing HIMS stock is crucial for current and prospective investors.

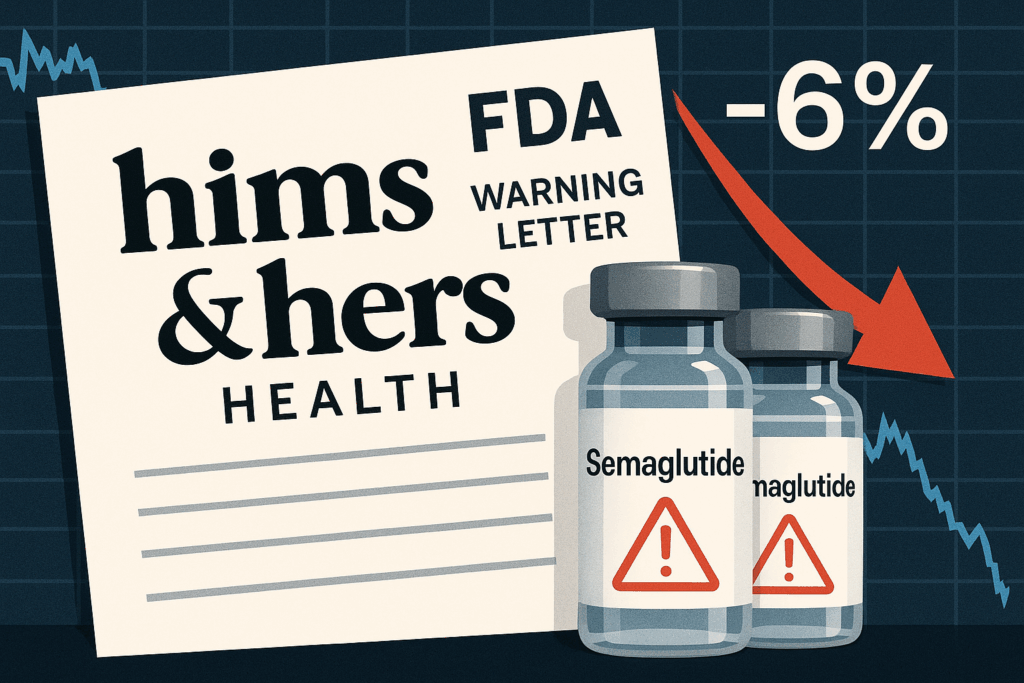

Recent Performance of HIMS Stock

As of October 2023, HIMS stock has shown a volatile trend, reflecting both market challenges and opportunities. After going public via a merger with a SPAC (Special Purpose Acquisition Company) back in January 2021, HIMS has experienced ups and downs, reflecting not just its operational results but broader market dynamics. In early October 2023, HIMS stock experienced a slight uptick, rising approximately 5% after the company reported an increase in quarterly earnings, surpassing Wall Street expectations.

Factors Influencing HIMS Stock

Several elements have impacted HIMS stock performance. The growing demand for telehealth services, accelerated by the pandemic, has been a primary driver for the company’s growth. HIMS expanded its offerings beyond men’s health into areas like mental health and general wellness, catering to a broader demographic. Moreover, the increasing competition in the telehealth space has also played a significant role, as investors assess HIMS’ position compared to its rivals.

Additionally, market sentiment around healthcare stocks plays a crucial role. With the recent discussions on healthcare reforms and regulations, potential investors are closely monitoring how such changes may affect HIMS. The company’s reliance on subscription-based services has proven resilient, yet it faces challenges with customer acquisition costs and retention in a competitive environment.

Conclusion

The outlook for HIMS stock remains cautiously optimistic. As the company continues to innovate and expand its services, its performance will likely reflect its ability to adapt to market changes and consumer needs. For investors, keeping an eye on upcoming earnings reports and broader industry trends will be key. While HIMS has shown potential for growth, the healthcare sector’s volatility necessitates thorough research and a sound investment strategy. In conclusion, HIMS stock represents both an investment opportunity and a reflection of ongoing shifts in the healthcare landscape, offering insights for those tracking market trends.