Introduction

The Bank of Canada plays a crucial role in shaping the Canadian economy. As the nation’s central bank, it is responsible for formulating monetary policy, issuing currency, and maintaining financial stability. Recent developments have drawn attention to the Bank’s strategies in managing inflation and interest rates amidst challenging economic conditions, making it a highly relevant topic for economists and the general public alike.

Recent Developments

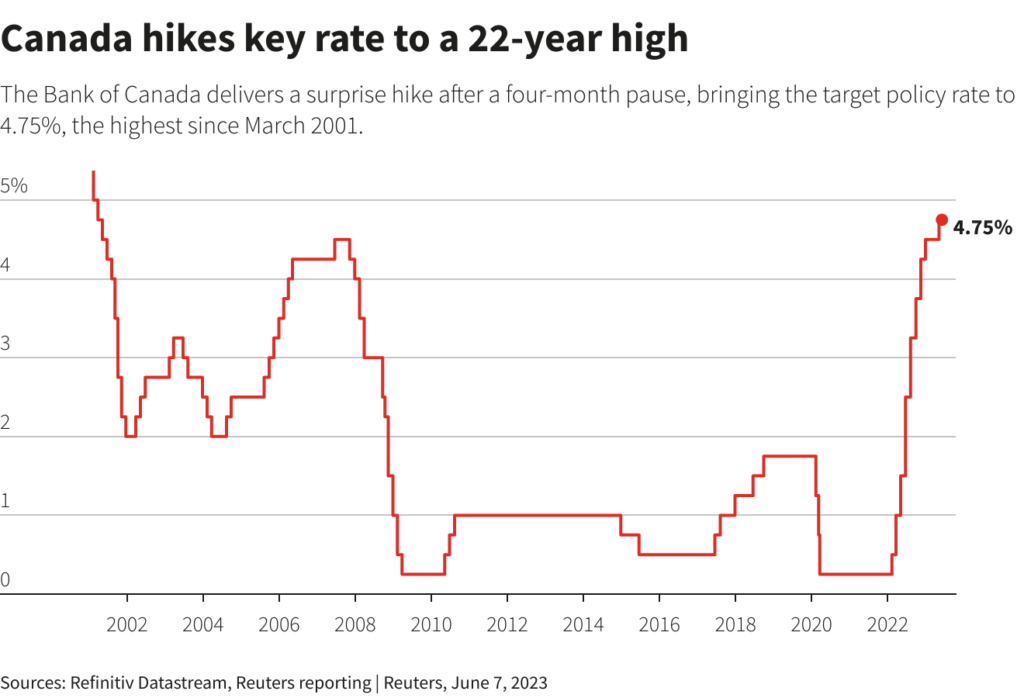

In October 2023, the Bank of Canada announced its decision to hold the key interest rate steady at 5.00%. This decision comes after several adjustments earlier in the year aimed at curbing inflation, which peaked at 7.0% in the summer of 2022. The goal of the current policy is to bring inflation down to its target of 2%. Given the rising costs of living, this decision has significant implications for consumers and borrowers.

Furthermore, the Bank of Canada has indicated that it will monitor economic indicators closely before making further interest rate adjustments. Governor Tiff Macklem stated in a recent press conference, “Our priority is to ensure that inflation is under control and that the economy remains stable. Our policies are designed to evaluate and respond to the evolving economic situation.” This approach underscores the Bank’s commitment to balancing inflation control with sustainable growth.

Impact on Canadians

The Bank of Canada’s actions significantly influence the everyday lives of Canadians. Interest rates determine the affordability of loans and mortgages, affect spending power, and impact small businesses. A stable economic environment, as indicated by the Bank’s current policies, could bolster consumer confidence and encourage spending, which is crucial for economic growth.

In addition, rising interest rates can have mixed effects. While they are necessary to manage inflation, they can also lead to higher borrowing costs that may deter consumers from making significant purchases. Consequently, Canadians are urged to stay informed of the Bank’s activities, as decisions made by the Bank can have lasting impacts on personal finances, investment opportunities, and overall economic prosperity.

Conclusion

The Bank of Canada remains a pivotal institution in maintaining the economic health of the country. As the global economy faces various challenges, the Canadian central bank’s actions in navigating inflation and interest rates will be closely monitored by citizens, businesses, and policymakers alike. The upcoming months will be crucial as the Bank evaluates economic performance and responds to shifts influenced by domestic and global factors. Understanding these dynamics is essential for all Canadians who wish to comprehend the broader economic landscape and make informed financial decisions.