Introduction

The stock market has been experiencing volatility in 2023, making it crucial for investors to stay informed about key stocks. SMCI, or Super Micro Computer, Inc., has garnered significant attention due to its growth in the technology sector.

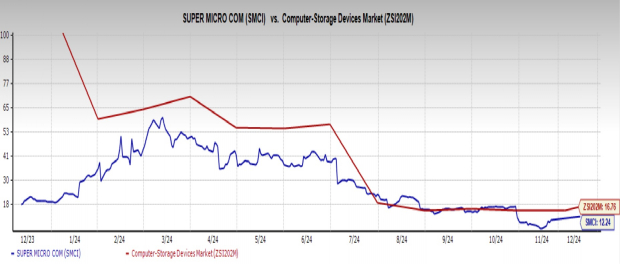

Current Performance of SMCI Stock

As of late October 2023, SMCI stock has been fluctuating at around $120 per share, reflecting a notable increase of approximately 45% since the beginning of the year. This rise can be attributed to the company’s robust financial performance and increasing demand for high-efficiency computing solutions. In its latest quarterly report, Super Micro announced revenues of $1.2 billion, which is a 35% increase compared to the same quarter last year. Analysts have attributed this growth to an uptick in sales for AI-driven products, particularly in the data center and cloud computing sectors.

Market Trends and Investor Sentiment

The global push towards artificial intelligence and cloud computing technologies has positioned companies like SMCI favorably in the market. With major tech firms ramping up investment in AI capabilities, SMCI has become a critical player by offering cutting-edge hardware solutions optimized for AI workloads. Furthermore, the company’s strategic partnerships with industry giants have bolstered its market position. These factors have sparked optimism among investors, contributing to positive sentiment and active trading in SMCI stock.

Future Projections

Looking ahead, experts predict continued growth for SMCI, with some analysts forecasting a potential target price of $150 per share within the next 12 months. This projection hinges on the sustained demand for computing hardware spurred by advancements in machine learning and big data analytics. However, potential market risks remain, such as supply chain disruptions and increased competition in the tech sector. Investors are advised to stay updated on these developments while considering the long-term implications of their investment in SMCI stock.

Conclusion

In conclusion, SMCI stock has demonstrated impressive growth amidst a rapidly evolving technology landscape. With increasing demand for high-performance computing solutions, the company appears well-positioned for future expansion. However, as with any investment, potential risks warrant careful consideration. Keeping an eye on market trends and company performance developments will be vital for those interested in SMCI stock.