Introduction

Fortinet, a global leader in cybersecurity solutions, has recently captured significant attention in the financial markets. As businesses around the world increasingly invest in digital security amid rising cyber threats, the performance of Fortinet stock has become a focal point for analysts and investors alike. Understanding the stock’s performance is critical for anyone looking to navigate the volatile tech investment landscape.

Current Performance

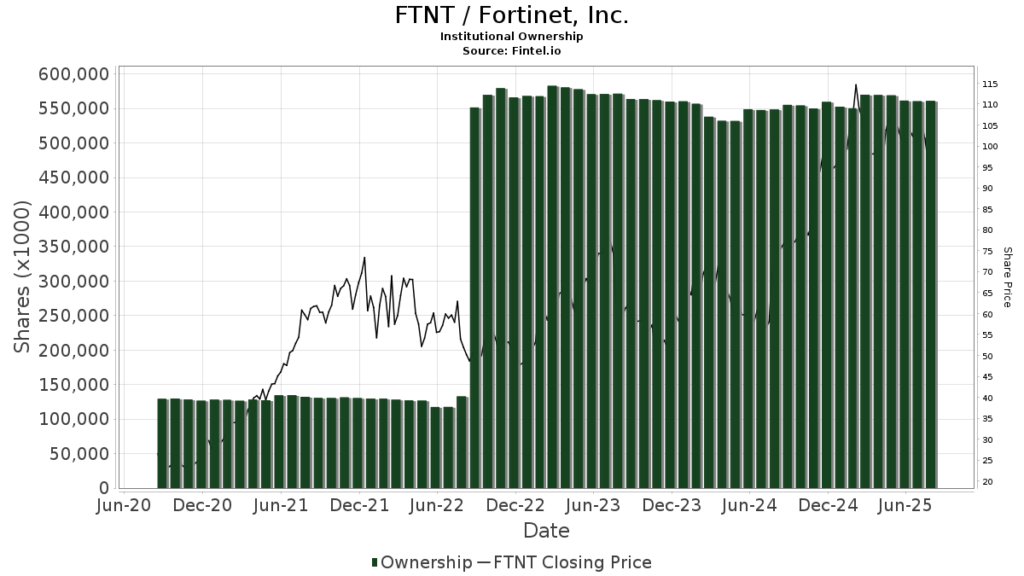

As of mid-October 2023, Fortinet’s stock (NASDAQ: FTNT) is trading near $75 per share, reflecting a year-to-date growth of approximately 30%. The company’s robust earnings report in July demonstrated a 20% increase in revenue compared to the same quarter in the previous year, driven by strong demand for its next-generation firewalls and cloud security services. Analysts attribute this success to the growing need for cybersecurity as businesses transition to remote operations and cloud services.

Market Factors Influencing Fortinet Stock

The cybersecurity industry is anticipated to grow to $345.4 billion by 2026, according to research from Fortune Business Insights. Factors influencing Fortinet’s stock include increased competition, broader adoption of artificial intelligence in security solutions, and ongoing investments in innovative technologies. Additionally, Fortinet has expanded its partnerships, including a strategic alignment with Microsoft to enhance its security offerings in the Azure ecosystem.

Future Projections

Wall Street analysts remain optimistic about Fortinet’s future, with an average price target set at $85 per share over the next twelve months. The anticipated growth is supported by the company’s consistent investment in research and development, with over $500 million allocated in 2023 alone. Investors will be closely monitoring upcoming financial reports and the company’s ability to maintain its market share amidst increasing competition from other cybersecurity firms like Palo Alto Networks and CrowdStrike.

Conclusion

Fortinet stock holds significant promise as part of the broader shift towards prioritizing cybersecurity in the digital age. While market fluctuations can impact pricing, the underlying fundamentals suggest a strong outlook for the company. As organizations continue to prioritize cybersecurity investments, Fortinet is poised to benefit from industry growth trajectory. Investors and analysts alike will need to keep a close watch on Fortinet’s performance amidst evolving market dynamics, making informed decisions based on comprehensive research and analysis.