Introduction

Duolingo, a leading language-learning platform, has recently become a subject of significant interest among investors and analysts as it continues to shape the digital education landscape. With a valuation that reflects its rapidly growing user base and innovative approach to learning, understanding Duolingo’s stock movements is essential for evaluating its potential as an investment opportunity.

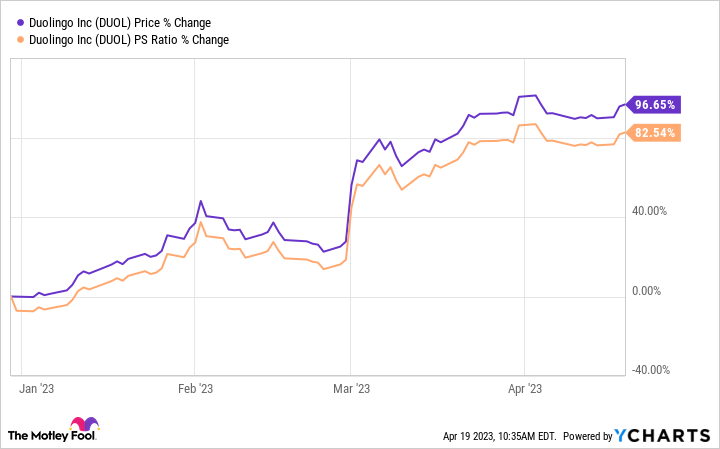

Recent Stock Performance

As of October 2023, Duolingo’s stock has experienced fluctuations, reflecting broader market trends as well as industry-specific factors. After its IPO in July 2021, where shares opened at $102, Duolingo’s stock reached an all-time high of $190 in late 2021, fueled by a surge in users during the pandemic. However, like many tech stocks, Duolingo faced volatility throughout 2022, with concerns over inflation and rising interest rates affecting growth potential. Recently, the stock has stabilized in the range of $50 to $70, with analysts expressing cautious optimism about recovery.

Factors Influencing Duolingo Stock

1. **User Growth:** As of September 2023, Duolingo reported over 50 million monthly active users, showcasing an increase in enrollment and engagement. Continued user growth is critical for future revenue potential.

2. **Expansion of Offerings:** In recent months, Duolingo has expanded its product offerings to include features such as Duolingo ABC for younger learners and Duolingo Stories for immersive language practice. These initiatives present additional revenue streams and enhance the app’s value proposition.

3. **Market Trends:** The global e-learning market is projected to reach $375 billion by 2026, creating a favorable environment for companies like Duolingo. As more individuals seek flexible learning solutions, the demand for its services is likely to rise.

Future Outlook

Looking ahead, experts agree that Duolingo’s focus on innovation and user engagement positions it favorably within the education technology sector. Analysts predict that as Duolingo navigates the post-pandemic landscape, its stock could benefit from increasing revenue streams and strong user retention metrics. However, potential investors should remain aware of possible market volatility and competition from other platforms, which may impact stock performance.

Conclusion

Duolingo stock presents a compelling case for investors interested in the ed-tech industry. With growth prospects tied to user engagement and product diversification, following the company’s performance through market changes will be crucial. For current or potential investors, understanding these dynamics will aid informed decision-making regarding Duolingo’s stock.