Introduction

FLT Stock, associated with Flight Centre Travel Group, has garnered significant attention in recent market discussions, especially given the resurgence of travel post-pandemic. As travel restrictions ease and consumer confidence rises, understanding the performance and future outlook for FLT stock is critical for both investors and market enthusiasts.

Current Performance of FLT Stock

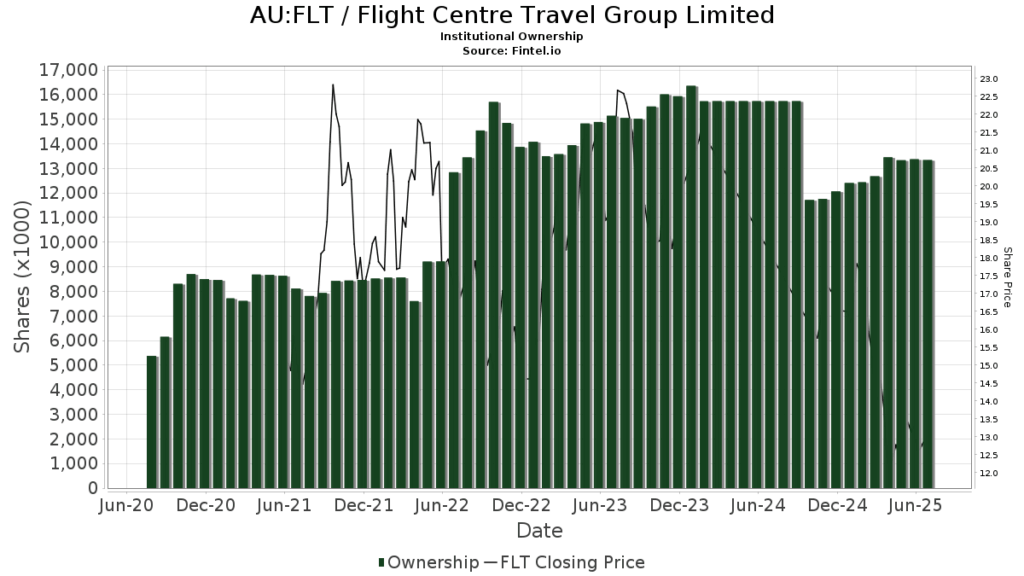

As of October 2023, FLT stock has shown a volatile but promising recovery following the unprecedented challenges faced by the travel industry during the COVID-19 pandemic. The stock price has seen a noteworthy increase of approximately 45% over the past year, reflecting a growing demand for leisure travel and corporate travel services. Analysts attribute this surge to several factors including a boost in international travel, enhanced consumer spending, and strategic investments by Flight Centre in technology and service offerings.

Key Factors Influencing FLT Stock

1. Demand for Travel: With international borders reopening, there has been a surge in travel bookings, pushing FLT’s revenue upwards. Reports indicate that the month of August saw a record level of bookings, helping to stabilize the company’s financial outlook.

2. Strategic Partnerships: Flight Centre has forged partnerships with airlines and hospitality entities which has allowed them to enhance offerings and attract new customer segments. The company’s ability to adapt to market demands quickly is a positive indicator for its stock.

3. Cost Management: In response to the fluctuating revenue during the pandemic, Flight Centre has implemented rigorous cost management strategies that have improved overall profitability. This careful financial management is appealing to investors.

Market Outlook and Predictions

Analysts are cautiously optimistic regarding the future of FLT stock. While short-term fluctuations are expected, the long-term trend suggests a strong recovery for the travel industry as both leisure and business travel rebounds. Investment firms have recommended FLT stock as a ‘buy’, noting its strong recovery potential as travel restrictions further relax and consumer behaviour shifts back towards travel.

Conclusion

In summary, FLT stock demonstrates significant potential for investors keen on capitalizing on the travel industry’s recovery. The combination of increased demand for travel, strategic partnerships, and effective cost management provides a fortified foundation for future growth. Investors should remain vigilant, as market dynamics can shift, impacting stock performance. Trends indicate that the upcoming quarters may present lucrative opportunities for those invested in FLT stock, making it a point of interest in the stock market.