Introduction

Tesla stock has remained a hot topic among investors and market analysts due to its volatility and significant implications on the electric vehicle (EV) market. As one of the leading manufacturers of electric cars, Tesla’s performance is closely watched not only by investors but also by those keen on the future of sustainable transportation. With the ongoing global transition towards greener energy, understanding Tesla’s stock trajectory is essential for informed investment decisions.

Current State of Tesla Stock

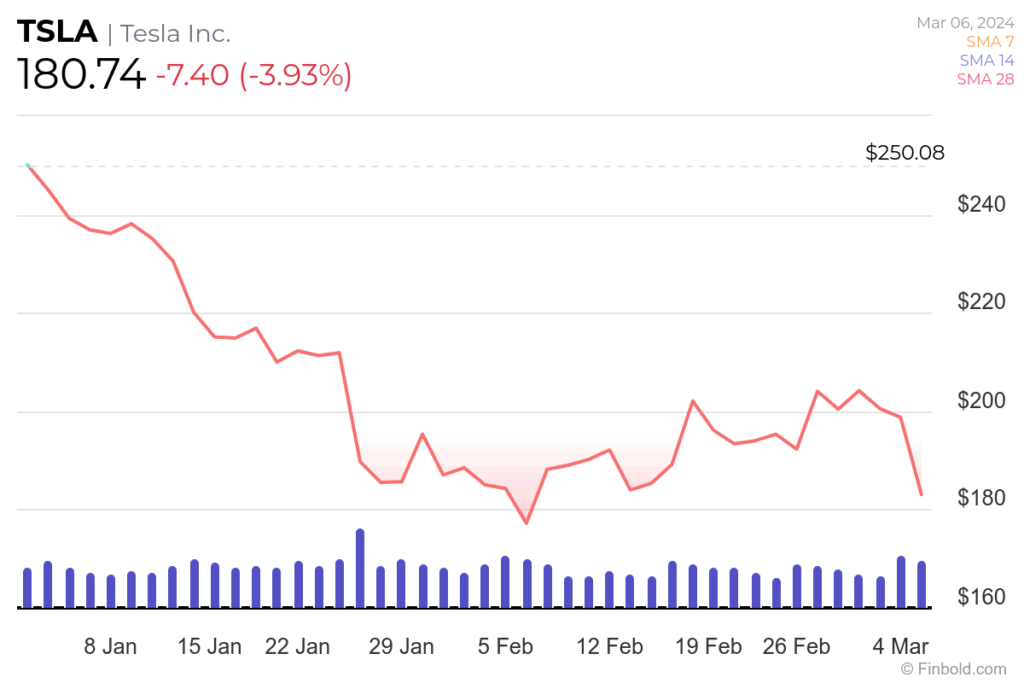

As of October 2023, Tesla’s stock has seen considerable fluctuations. Shortly after a major product launch, shares surged by approximately 7%, reflecting investor optimism regarding the new model’s potential. Analysts attribute this positive movement to both strong pre-order numbers and the company’s expanded manufacturing capabilities in new locations. However, concerns regarding production delays and supply chain issues have continued to dampen some investor confidence.

Recent Financial Performance

In its latest quarterly earnings report, Tesla reported revenues exceeding $30 billion, significantly up from last year. Despite this growth, earnings per share slightly missed analyst expectations, which caused a temporary dip in stock prices. The analysts are optimistic, suggesting that Tesla continues to remain well-positioned in a rapidly evolving market. The average price target among major investment firms stands at $300 per share, indicating a potential upside for investors.

Market Impact and Competition

With increasing competition from legacy automakers pivoting to electric vehicles, such as Ford and GM, as well as new entrants like Rivian and Lucid Motors, Tesla’s market share could be affected. Analysts suggest that as more players enter the EV market, Tesla must innovate continuously to maintain its leadership. The company’s recent focus on software capabilities, including improvements to its autonomous driving features, has been seen as a strategic approach to differentiate itself.

Conclusion

In conclusion, Tesla stock remains a pivotal player in the stock market, influencing not just the automotive industry but also broader economic trends toward sustainability. The future outlook seems cautiously optimistic, with ongoing innovations and a potential rise in demand for electric vehicles. For investors, monitoring Tesla’s performance and market strategies will be crucial in navigating the complex landscape of EVs in the coming years. With forecasts indicating robust growth potential, Tesla stock continues to hold relevance for both seasoned and new investors.