Introduction

Netflix, the streaming giant that revolutionized the way we consume media, continues to be a focal point of interest for investors. As of late 2023, the performance of Netflix stock holds significant relevance amid ongoing market fluctuations, technological advancements, and evolving viewer preferences. Understanding its stock dynamics can provide insights into not only Netflix’s future but also the broader entertainment industry.

Current Performance of Netflix Stock

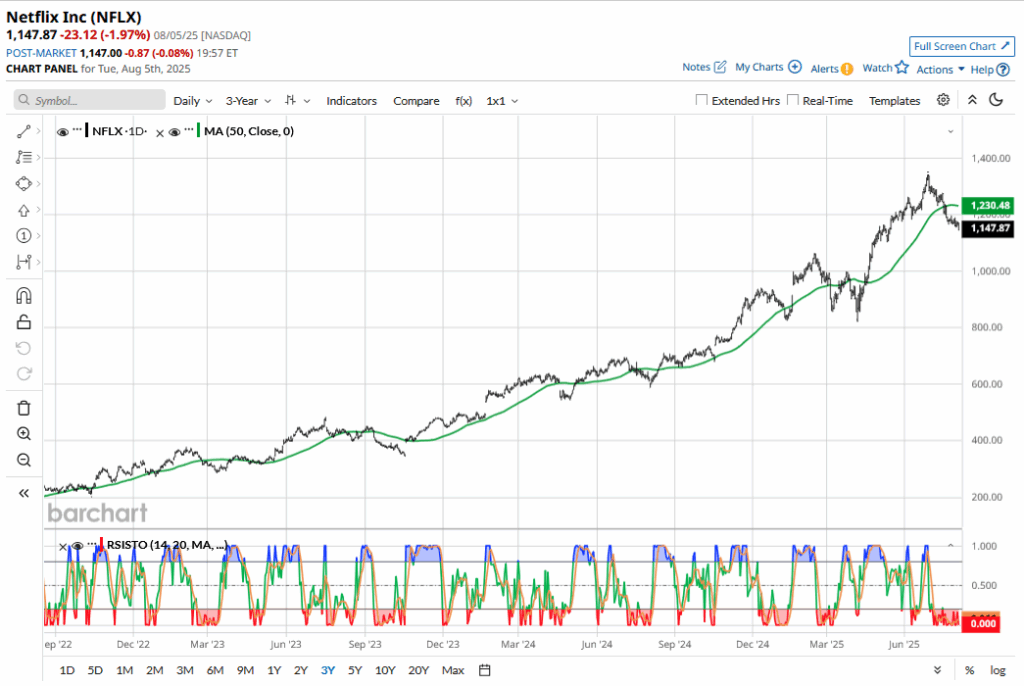

As of October 2023, Netflix’s stock has shown promising recovery from previous market downturns. Following a dip in early 2023, attributed to increased competition and subscriber growth concerns, the company has rebounded. Currently, Netflix stock trades at approximately $450, up from $320 earlier in the year.

The rise in stock value can be attributed to several key factors: an expanded international subscriber base, strategic partnerships with tech companies, and the introduction of new content formats, including interactive storytelling and documentaries. Furthermore, the company’s keen focus on original content has helped it solidify its market position, countering rivals like Disney+ and Amazon Prime Video.

Influencing Factors

Several elements are influencing Netflix’s stock performance:

- Subscriber Growth: Netflix announced it gained over 10 million new subscribers in the last quarter, driven by popular series releases and enhancements to its user interface.

- Cost Management: The company has effectively managed production costs while still delivering high-quality content. This contrasts with competitors who face greater financial pressures.

- Market Trends: With the global shift towards remote work and home entertainment, streaming services have seen increased demand, providing Netflix with a favorable market environment.

Challenges Ahead

However, Netflix stock is not without its challenges. The intense competition in the streaming industry is a persistent threat. New entrants and established competitors continuously innovate, often leading to subscriber churn. Additionally, macroeconomic factors such as rising inflation could lead to increased subscription cancellations as consumers reevaluate discretionary spending.

Future Outlook

Analysts have mixed predictions on the future of Netflix stock. Some posit that with ongoing investment in technology and content, combined with its strong brand loyalty, the stock could reach the $500 mark by the end of 2024. Conversely, pessimists warn that content saturation and economic challenges could hinder growth.

Conclusion

In conclusion, Netflix stock presents both opportunities and risks. While its recent performance shows strong potential for growth, investors should remain vigilant regarding the competitive landscape and economic shifts. As Netflix continues to evolve and adapt, monitoring these dynamics will be crucial for anyone looking to invest in the future of entertainment.