Introduction

Investment in biotechnology stocks has become increasingly popular, especially as the healthcare sector continues to evolve. One stock that has garnered attention is the NeuroBo Pharmaceuticals Inc. (NASDAQ: NBIS), a biopharmaceutical company focused on developing innovative therapies for neurodegenerative diseases. Understanding NBIS stock’s performance is vital for investors looking at the biopharmaceutical market and its fluctuations in 2023.

Recent Performance of NBIS Stock

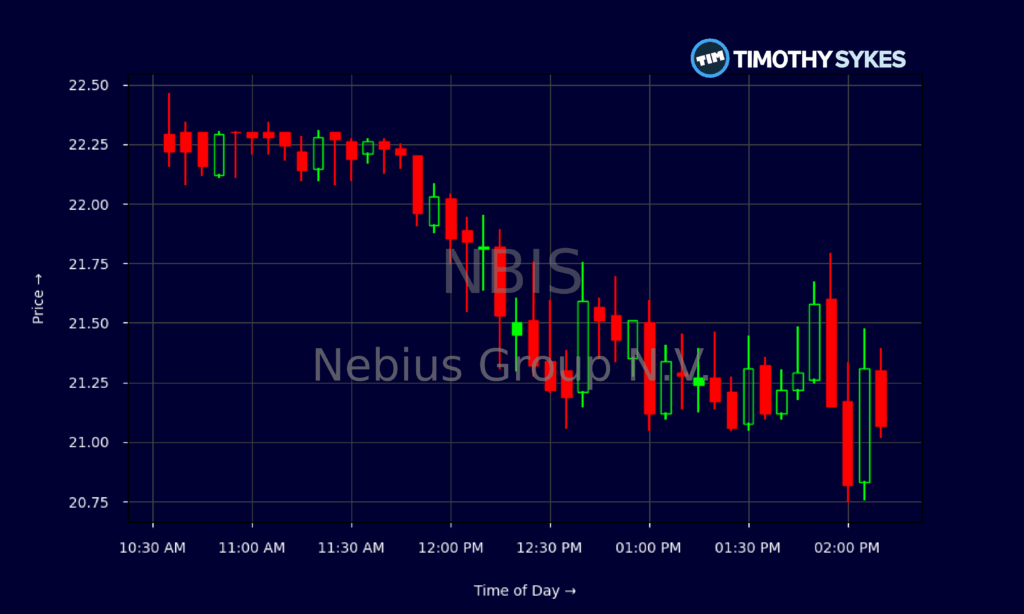

As of October 2023, NBIS stock has shown some volatility, reflective of the wider market pressures faced by biotech firms. Over the last few months, the stock has fluctuated between $1.50 and $2.50, with analysts highlighting various clinical developments as significant catalysts influencing these movements. The company recently presented promising data concerning its flagship product, NB-01, indicating potential effectiveness in treating conditions such as Type 2 diabetes and obesity, which helped boost investor confidence.

Market Influences and Analyst Opinions

Analysts have noted that the biopharmaceutical sector often experiences sharp price movements based on trial results and FDA approvals. For NeuroBo Pharmaceuticals, positive outcomes from ongoing clinical trials are critical for instilling investor faith. However, the company has also faced challenges, including funding pressures and competition from larger firms with more established portfolios. Despite this, some analysts maintain a “Buy” rating for NBIS stock, citing its long-term growth potential as developmental drugs reach the market.

Future Outlook

Looking ahead, the future of NBIS stock will depend significantly on upcoming clinical trial results, potential partnerships, and the overall market environment for biotech companies. With an increasing focus on innovation in healthcare, NeuroBo’s niche could offer lucrative returns for investors willing to accept the inherent risks of the biotech sector. The recent trend shows a cautious optimism among investors, but as with all investments, especially in biotech, thorough research and a good grasp of market dynamics are essential.

Conclusion

NBIS stock stands as a compelling figure in the biopharmaceutical space, attracting the attention of investors due to its innovative approach to treating neurodegenerative diseases. While its market performance remains volatile, the prospects tied to clinical advancements and strategic decisions could provide significant opportunities. As the situation evolves, regular updates on clinical outcomes and market trends will be crucial for stakeholders and potential investors alike.