Introduction to CPP Payments

The Canada Pension Plan (CPP) is a mandatory social insurance program that provides retirement, disability, and survivor benefits to Canadians. As one of the cornerstones of the Canadian retirement system, CPP payments are crucial for individuals planning their future financial security. Understanding how these payments work and who is eligible can significantly impact the well-being of retirees.

Eligibility for CPP Payments

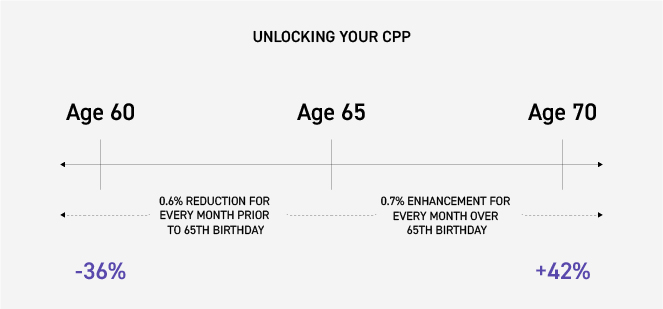

To qualify for CPP payments, an individual must have made contributions to the plan during their working years. The minimum requirement is to have contributed for at least one valid year. The amount received upon retirement is based on the contributions made over the years, as well as the age at which benefits are claimed. Canadians can start receiving CPP payments as early as age 60, but the standard age for full benefits is 65. Delaying payments until after 65 can result in a higher monthly benefit amount.

Recent Changes and Updates

In 2023, the CPP retirement benefit increased by 1.8% to account for changes in the cost of living, in line with inflation. This adjustment is part of a long-term plan to ensure that the CPP remains sustainable and that beneficiaries receive adequate support. Notably, the maximum monthly payout for new beneficiaries as of 2023 is approximately $1,306.57, given that they have contributed the maximum amount throughout their working life.

How to Apply for CPP Payments

Applying for CPP payments can be accomplished online through the Service Canada website, by mail, or in-person at local Service Canada offices. The application process requires individuals to provide personal information, including their employment history and banking details for direct deposit. Typically, it takes about 3 to 4 months for the application to be processed. Individuals are encouraged to apply as early as they become eligible.

Conclusion

As Canadians navigate their retirement planning, understanding CPP payments is essential. With ongoing adjustments to ensure the program is responsive to economic changes, retirees can better prepare for their financial futures. The CPP not only provides financial support during retirement but also ensures that individuals who face disabilities or have lost a spouse can sustain their livelihoods. As always, it is advisable for individuals to stay informed about their eligibility and benefit amounts to maximize the advantages of this vital program.